Photo courtesy of BrightView

With news of BrightView filing for an IPO yesterday, it makes official what has been widely speculated throughout the industry – the company going public. And some industry insiders say the move is a positive for the landscaping and lawn care world.

“In the big picture, this totally legitimizes the green industry and profession,” said Tom Fochtman, founder of Ceibass Venture Partners, an investment banking firm based in Denver. “A successful IPO and ultimately a publicly owned company puts landscaping on the map in a big way."

Fochtman said it was one thing to have private equity firms investing in the green industry, but BrightView’s move adds to the number of eyes on landscaping.

“Having a publicly owned company, owned by both individual and institutional investors, shines a very bright light on our profession,” he said.

BrightView reported a revenue of $2.3 billion in revenue last year, making it the highest grossing landscape company in North America and No. 1 on Lawn & Landscape’s Top 100 list. The company, based in Plymouth Meeting, Pennsylvania, employs 22,000 people.

Formed in 2014 when KKR, parent company of Brickman, acquired ValleyCrest from Michael Dell’s MSD Capital, the combined companies rebranded as BrightView in 2016. MSD is still a minority shareholder of BrightView according to the SEC statement.

“I think this is incredibly positive news for KKR and BrightView as well as for the commercial landscape industry,” said Brian Corbett, founder and managing partner of CCG Advisors, an investment banking firm based in Georgia and Tennessee that specializes in the commercial landscape industry. “The IPO validates the tremendous investment made by KKR and other private equity groups in the sector over the last five years.”

The company did not comment beyond a statement confirming the filing. You can read the S1 registration here.

While ServiceMaster, former parent company to what is now LandCare, was a public company before being taken private in 2007, BrightView will be the first pure-play, publicly-traded commercial landscape service company in the U.S., Corbett said.

BrightView has filed for an IPO of $100 million but Fochtman said that could grow.

“The $100 million is testing the IPO waters and my guess is will get amended for a much higher amount,” he said. “Or there will quickly be a secondary offering. It’s more capital to invest in acquisitions. The $100 million does nothing to pay down debt.”

In the past few years, mergers and acquisitions activity has been high in the green industry, which you can read more about here. BrightView especially has been active, making a number of acquisitions, most recently scooping up Environmental Earthscapes, a Tucson, Arizona-based firm that operates as The Groundskeeper. The company posted $68 million in 2017 revenue and ranked 19th on the Top 100 list.

BrightView included in its filing that it has acquired eight businesses with more than $188.2 million in total revenue since Jan. 1, 2017. For some perspective on the size of those acquisitions, Gothic Landscape, which ranked 5th on the Top 100 list, generated $182 million revenue last year. So, BrightView’s acquisitions alone in just a year combined for enough revenue to be the fifth largest landscaping company.

Ron Edmonds, president of The Principium Group, an advisory firm serving the lawn and landscape industry in the areas of mergers & acquisitions and exit planning, said the offering could be a sign that KKR wants to sell BrightView.

“This is a partial exit strategy for KKR & Co. With transactions like BrightView, the exit strategies are more limited as there are not as many private equity companies with an appetite for a business this large,” Edmonds said. “The continuing existence of viable exit strategies will help fuel further private equity investment.”

While there is positive feedback from the move, there is some concern this could affect how BrightView services customers. Some comments on Lawn & Landscape’s Facebook page after the initial IPO story was posted indicated the company could be more focused on servicing shareholders instead of customers.

“That is a concern with public companies – serving shareholders more than customers, but all the great public companies that one can rattle off have found the right mix,” Fochtman said. “It will be Brightview’s decision on how they operate. One thing KKR has learned is that it’s a people business – employees and customers. And the basics of what it costs to replace a client vs renew a client. It remains to be seen, but this is not a concern I have at the moment.”

With BrightView filing for an IPO, another large green industry company could also go public. David Alexander, president of TruGreen, a $1.3 billion company that ranked second on Lawn & Landscape's Top 100 list, told the Commercial Appeal last July that the company could go public.

“The situation with TruGreen is pretty similar and I would expect them to initiate a public offering as a partial exit strategy for their private equity owners, Clayton Dubilier & Rice, in the relatively near future, just as ServiceMaster did earlier,” Edmonds said.

Fochtman said it’s hard to say when the M&A activity in the industry will die down, but even with no end in sight, he said now is the time to sell.

“I’ve said many times to my clients, as the owner of a large commercial landscape company, I’d have sold it by now,” he said. “There has never ever been a better time to be a seller. I think there is more runway here but hard to say how much. I think everything is lined up to continue to be a seller’s market, but if I’m a seller, I don’t sit on the sidelines much longer. I make it happen now.”

Latest from Lawn & Landscape

- LawnPro Partners acquires Ohio's Meehan’s Lawn Service

- Landscape Workshop acquires 2 companies in Florida

- How to use ChatGPT to enhance daily operations

- NCNLA names Oskey as executive vice president

- Wise and willing

- Case provides Metallica's James Hetfield his specially designed CTL

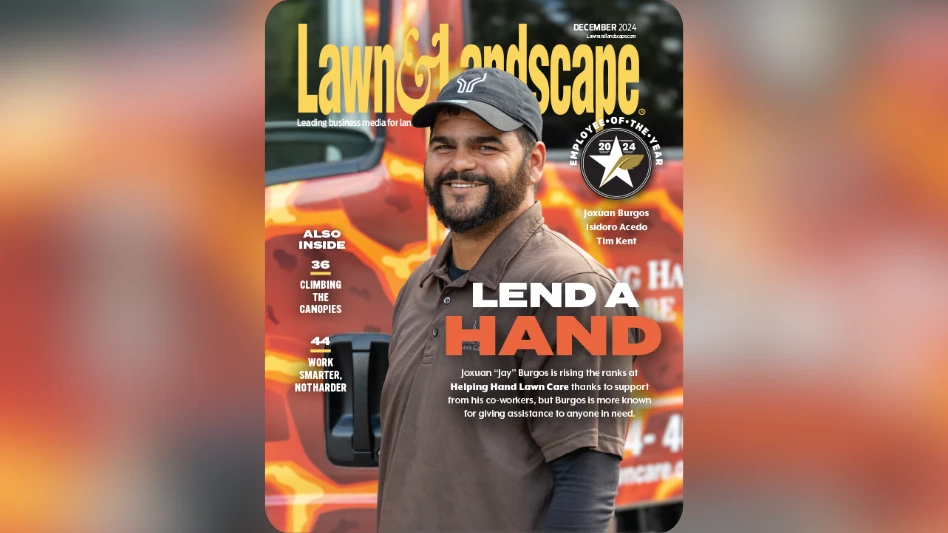

- Lend a hand

- What you missed this week