The National Association of Landscape Professionals’ annual Breakfast With Champions at GIE+EXPO always brings in a full house, and this year was no exception. With 54 tables, there were few empty seats.

Each table features a topic ranging from accounting and finance to operations, and the "champion" at each table moderates the discussion.

Table 11, moderated by Peter Holton, managing director, Caber Hill Advisors, was focused on how to sell your business.

"The No. 1 factor why businesses don't sell is unrealistic expectations," Holton said. He added that 80 percent of all businesses listed for sale never sell, not just in the green industry.

When looking for a business, buyers are going to look for one with good customer concentration and good recurring revenue. They're also going to be more interested in a company that has systems and processes set up and running smoothly.

Holton recommends selling the business, but not the property.

"Just because the real estate works for you, doesn't mean it'll work for them," he said. You can always sell the property separately a few years later, or even when you retire, and get that extra amount of income.”

Table 33 featured Wally Sutt, business development manager for Ariens/Gravely, talking about building a relationship between a landscape contractor and a local dealer.

One of the attendees at the table had only been in the industry for five months, but Sutt said the topic was still just as important to him.

"From your point all the way up to the owner, there's always some type of relationship with the dealer," Sutt said. He said the best, and easiest, way to start the relationship is by finding a mutual point between you and the dealer, and building from there.

Friday’s breakfast featured topics ranging from Hydroseeding 101 to making sure your website is ready for 2016.

Ron Edmonds, president of the Principium Group, spoke to his table on the topic of using mergers as a business growth strategy.

“A lot of times, people assume growing by acquisitions is more expensive than growing organically,” he said, “and I don’t buy that.”

The table had six attendees, including a man from Houston who said he had a $2-million company and acquired a $1-million company. Within three months, his company was making $4 million.

Another attendee from Boston said a company had approached her company about buying.

Edmonds said the first thing she needs to ask is “Why are you selling?”

“There are a lot of compelling reasons people have for selling a business,” he said. “Many are personal reasons.”

Latest from Lawn & Landscape

- Our Holiday Lighting Contest rolls on

- LawnPro Partners acquires Ohio's Meehan’s Lawn Service

- Landscape Workshop acquires 2 companies in Florida

- How to use ChatGPT to enhance daily operations

- NCNLA names Oskey as executive vice president

- Wise and willing

- Case provides Metallica's James Hetfield his specially designed CTL

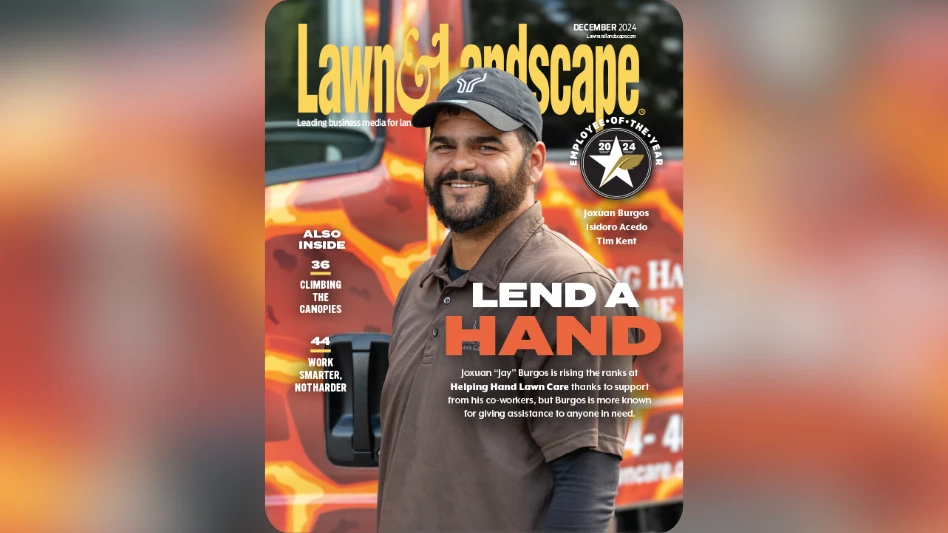

- Lend a hand