Manufacturers of the small gas engines used in lawn and garden equipment have had to comply with tighter U.S. EPA emissions regulations since 2010. The resulting changes have had an impact on price, design, efficiency and performance.

In general, Tier 3 reduced emissions by at least 75 percent while also improving fuel efficiency. In some cases, it also improved the durability and performance of engines.

Jay Albright, engineering manager with Subaru Industrial Power Products, says that the new regulations added a significant cost to Subaru’s design and manufacturing process.

“We’ve paid a high price in terms of facilities and overhead, including new testing labs,” he says. “There are also secondary issues such as labeling and paperwork. Every engine crossing our border must have a declaration of EPA emissions status.”

In terms of design, most manufacturers have avoided using exhaust catalysts because of the cost and complexity, and they’ve instead focused on “leaning out the carburetor.”

Rick Zeckmeister, vice president of North American consumer engine marketing for Briggs and Stratton, says that the company’s small gasoline engines have improved their performance in recent years, though not necessarily entirely because of Tier 3.

“While we’ve reduced our exhaust emissions another 35 percent on top of 75 percent required by Tier 3. Startability has also improved,” he says. “We guarantee our engines will start in two pulls or less. We also offer a two year consumer warranty on engines.”

The biggest change resulting from Tier 3 requirements is fuel efficiency, says Albright. “Pollutants are more or less a direct indicator of the amount of fuel you’re burning, so when you have lower emissions, then that means you’re burning less fuel,” he says.

The challenge for engine manufacturers, these companies say, is meeting the new Tier 3 requirements without sacrificing the performance that consumers expect and demand.

One of the big challenges of such small gasoline engines is that they must be designed to accept up to 48 different fuel blends. Additionally, they cannot take gas with ethanol content greater than10 percent, which is a challenge since E15 is now on the market.

“As long as we stick with carburetors, there’s a limited amount that we can do,” says Albright. “As you move up to fuel injection, you have a lot more latitude. But the price of these small engines won’t even come close to absorbing the cost of fuel injection.”

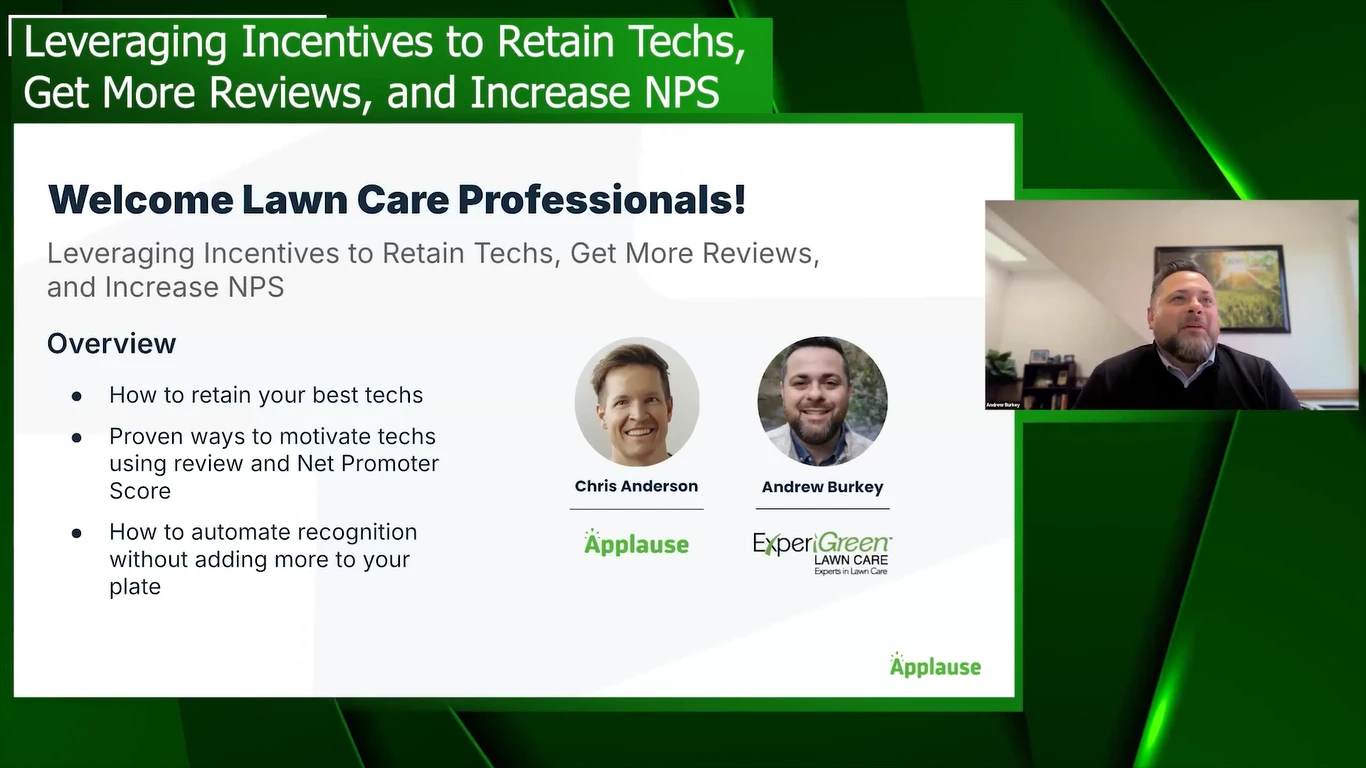

Sponsored Content

A Secret Weapon for Growing Your Lawn Care Business

Retargeting ads allow you to re-engage visitors who leave your lawn care website without converting, helping you stay top-of-mind and increase leads. This article explains how retargeting works, why it’s effective, and how to implement it for your business.

Complete Online Marketing SolutionsInstead, Subaru is adapting to alternative fuel usage by working with third party manufacturers to modify and recertify engines to use propane and natural gas.

In terms of price increases seen by consumers, Zeckmeister says that costs of B&S mowers have gone up by as little as $10 for a walk-behind to $50 for a larger mower.

Get curated news on YOUR industry.

Enter your email to receive our newsletters.

Explore the October 2012 Issue

Check out more from this issue and find your next story to read.

Latest from Lawn & Landscape

- PERC helps debut propane direct-injection fuel system at ACT Expo 2025

- Retargeting Ads – A Secret Weapon for Growing Your Lawn Care Business

- Leading a growing company

- Project EverGreen launches Clean Air Calculator

- Rain Bird acquires smart lawn care company OtO from Toronto

- PBI-Gordon names Marvin as VP of research and development

- Mean Green rolls out Vanquish Autonomous mower

- Focal Pointe launches new podcast series