Incorporating a business has several advantages: protecting the assets of the shareholders and officers, improving the image of the company and saving money on taxes.

Incorporating a business has several advantages: protecting the assets of the shareholders and officers, improving the image of the company and saving money on taxes.

Each of these benefits can easily be taken away. There is no guarantee that just because you incorporate all your individual assets are protected from the business, or that the benefits will automatically happen.

It takes work on the owner’s part to put the corporation in compliance. The three mistakes I often see small business owners making in this area are:

Mistake NO. 1 – No stock certificates are issued and shareholders recorded. After a corporation is formed, shares need to be issued to the owners. Without issuing the shares, the corporation veil could be pierced in a lawsuit because the court will claim the company is just an alter-ego of the individual.

Issue shares for the business by filling out a stock certificate and recording the transaction in a stock register.

Mistake NO. 2 – The initial meeting of shareholders and directors is not held. Every corporation when it is first formed needs to have an initial meeting with the shareholders and directors in order to adopt the articles of incorporation, the bylaws and to issue the shares for the incorporating company.

Mistake NO. 3 – No resolutions or other documentation is kept. Every corporation needs to maintain corporate resolutions and meeting minutes. A corporate resolution is a written document that gives someone in the company authority to perform a specific action. For example, if the business needs a loan, a resolution would be written and signed by the director of the company giving authority to an individual to open the loan and use it for business purposes.

You can track your corporate records with a corporate record book or corporate management software.

The author is president of Business Credit Services, and can be reached via www.smallbusinessconsulting.com.

Explore the September 2009 Issue

Check out more from this issue and find your next story to read.

Latest from Lawn & Landscape

- Our Holiday Lighting Contest rolls on

- LawnPro Partners acquires Ohio's Meehan’s Lawn Service

- Landscape Workshop acquires 2 companies in Florida

- How to use ChatGPT to enhance daily operations

- NCNLA names Oskey as executive vice president

- Wise and willing

- Case provides Metallica's James Hetfield his specially designed CTL

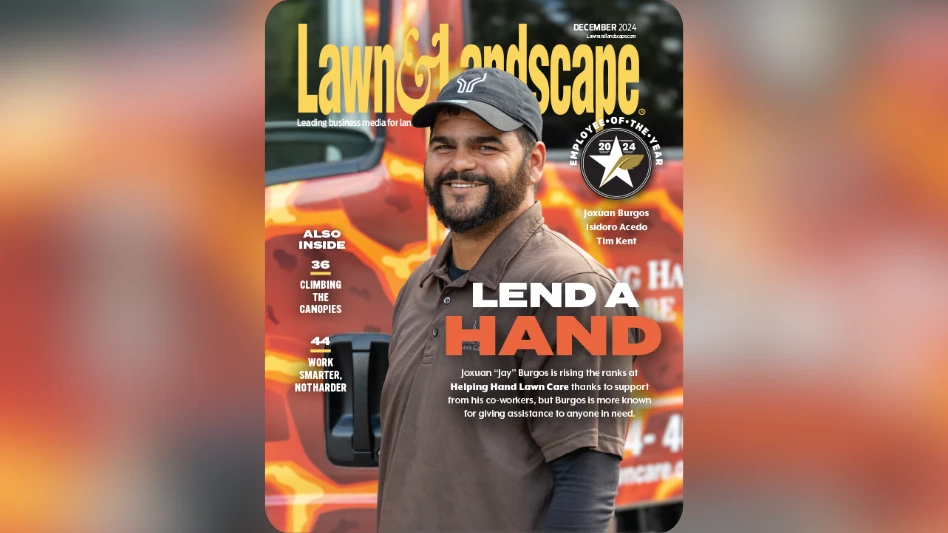

- Lend a hand