.jpg) girard environmental services

girard environmental services

|

|

Commercial work has a reputation in the industry.

- The customers, many times, aren’t as picky as residential.

- The accounts are larger, so that’s more to gain … and more to lose.

- The hours can be better – work is scheduled early in the week; no one is demanding work be done on Friday to appease weekend plans.

- Loyalty can be fleeting. When money is tight, work goes out to bid. Sometimes lowest price wins.

- The properties usually require more work, meaning more revenue and more hours on the job.

- The mix of property types – from apartment complexes to retail centers to gated communities and HOAs – means more variety. So when one area suffers, another is typically stable.

While everyone’s attention has been on subprime lending, other residential real estate crises and their affects on landscape design/build and maintenance work, commercial contractors have been hanging on. But, across the country, they have slowly started to feel the economy’s affects. Rising vacancies and tenant pressure have led to budget cuts. Rebidding work and cutting services has become the norm. Competition has grown as contractors who took care of primarily residential properties are trying to make up their losses in the commercial market.

“It’s a new era of caution and low risk,” explains Judy Guido, principal of Guido & Associates, a California-based green industry consulting firm. “Commercial property managers are continuously asking themselves, ‘What’s the greatest return on investment and the path of least resistance?’”

So if you’re a commercial landscaper today, the solution to your economic problems lies in flexibility and service and client variety. “To get the edge on competitors, provide ongoing client education focusing on cost-savings and regulatory and compliance issues – treat your customers’ landscape portfolios like their investment portfolios,” Guido says. “Leading brands, experience, clean track records, credentials, financial bandwidth and multiple services are those seen as safe bets to win.”

Market status

Market status

“The very foundation of the commercial real estate industry is cracked,” explains Ross Moore, Colliers International’s executive vice president and director of market and economic research. Overdue lease payments, credit shortages, vacant storefronts and homeowners association due delinquencies are just some of the problems facing the downtrodden market, he says.

He estimates $400 billion a year in commercial loans will require refinancing during the next 10 years.

At a recent congressional Joint Economic Committee hearing, Chairwoman Carolyn Malony, D-N.Y., called the commercial real estate market a “time bomb” that could spur a second wave of losses at banks and force shopping center and hotel owners to declare bankruptcy. The problem could also stymie economic recovery, considering commercial real estate comprises 13 percent of the U.S.’s gross domestic product and is valued at $6.7 trillion.

Banks’ reluctance to lend is contributing to the increase in the number of delinquent properties.

Commercial real estate values across the country have dropped 35 percent from their peak in October 2007, according to Moody’s REAL Commercial Property Price Indices. Transactional volume also fell along with value, which is showing signs of effects from distressed sales. Robert Bach, senior vice president and chief economist at Grubb & Ellis, a real estate investment company, expects prices of commercial properties to drop another 15 percent, putting total losses at 45 to 50 percent once the market hits bottom in 2010. Prices will continue to languish through 2011 and begin rising in 2012, he adds.

Though commercial real estate will be a problem, it won’t be as dire as the home mortgage bubble that burst and sent the economy reeling, Bach insists. “The solution is to simply wait it out until demand and supply are again in balance,” says Barry Bosworth with the Brookings Institute, Washington, D.C.

Commercial contractors offer similar predictions, following the maxim: “It’s going to get worse before it gets better.” “I see a continual slowing with things starting to pick up in about 18 to 24 months,” predicts Donnie Garritano, president, D&K Landscape, Las Vegas.

“I think we’re going to feel it more in 2010 than we have this year,” forecasts Jody O’Donnell, president of the 100-percent commercial, Carrollton, Texas-based LMI Landscapes.

The price isn't right, but it works

According to Lawn & Landscape research, 64 and 58 percent of commercial contractors, respectively, report their biggest challenges today are commercial customers cutting back services and increased bidding/competition forcing prices down.

Guido’s interview results from more than 200 commercial property managers show landscaping cost reductions are running at 14 to 28 percent.

“The days of spending thousands and thousands of dollars on drive lane flower rotations is past,” shares P. Marc Fischer, senior vice president and director of management services with Transwestern, and a former president of the Building Owners and Managers Association (BOMA) in Baltimore. “Our property managers are sharpening their pencils and paring down what their tenants may consider ‘frills.’”

These frills tend to include exterior work. George Gaumer, vice president and general manager of Kent, Ohio-based Davey Commercial Landscape Services says “landscape maintenance is one of the budget line items that can be reduced without significant repercussions, whereas postponing the repair of a leaky roof or a deteriorating staircase can have costly consequences.”

In some cases, the pricing pressure is harder to handle.

When asked how commercial customers are treating him, Gary Benson, president of Buffalo, N.Y.-based Dreamscapes Landscaping summed it up in two words: “Like garbage.”

The situation has put some contractors in what Terry Holum, business development manager for Chicago-based Landscape Concepts Management, calls “panic mode.” “They are offering unprecedented discounts that are probably not sustainable,” she says.

“We’ve had commercial clients switch providers for what seems like even a $5 difference in cost estimates,” adds Zoran Ploscar, president of Detroit’s Kingspointe Services.

Unfortunately, “hiring an unknown landscaper at 30 to 50 percent less than was spent in past years is viewed to be the lesser of the evils, and property managers are willing to take that risk,” Gaumer adds.

“Landscaping, though, is still a critical budget item even in recessionary times,” Fischer insists. “It remains at the top of the list. It’s easy to hide something within the confines of the mechanical room, but not within the exterior landscapes around buildings.”

Even for properties that are in trouble financially, O’Donnell says “we are either finishing, redoing or helping to reposition commercial properties for sale, which almost invariable involves some sort of redo of the landscape. I think that will be one of the most significant opportunities of the industry for the next several years.”

|

|

And BOMA in its recent “Strategies for Creating Asset Value in a Down Economy” report is pushing its members to focus on preventive maintenance as a means of remaining vacancy free. This includes making sure buildings show beautifully at all times, using the same vendor for multiple properties, using a predictive maintenance schedule vs. a fixed one, maintaining safety by eliminating hiding places created by landscaping, removing snow to keep pathways clear, maintaining pest control, and maintaining sprinkler system preventive maintenance.

Working with vs. against the property manager is the key. For instance, all of Minneapolis-based Northmarq’s office park landscapes under vice president of retail property managers Wend Aaserud’s watch are cutting back on expenses. “We are trying to maintain the asset to its normal standards but are also trying to find ways to keep costs down.” Based on her landscape contractor’s recommendations, Aaserud reduced costs by decreasing the standard 26 mows to 24, choosing less showy perennials over annuals, and agreeing to seeding over sodding to repair winter kill – and all of these solutions are helping the bottom line.

Basically, “landscaping services are now secondary to customer service,” Guido points out.

“We are constantly educating the customer about the reasons why you get what you pay for,” Garritano says. His prices are already what he calls “down and dirty,” but he has promoted value-added services, such as chemical lawn care applications when necessary, as a means of boosting contract worth.

Lee Edwards, president of The Greenery in Hilton Head, S.C., has gone through frequent rebidding for property managers who are being told by the “number crunchers upstairs” they have to cut their budgets in half and put projects out to bid to find the lowest price. So he started being proactive and approached some of his clients who he knew were having tough times. “For one big resort client of ours, we knew things weren’t going well,” he says. “They were paying $100,000 a month in maintenance, so we went to them and said, ‘Hey, we’re blowing off debris and picking up pine cones almost every day. We can reduce this and still have the place looking topnotch.’”

“The key,” Edwards adds, “is the relationship. If you hear a client is cutting budgets and going to bid, make sure you can take part in the process. We’ve been taking care of a development in Savannah for four years, and they were told to go with the lowest bidder. Someone will always be lower than us. I offered to continue to do the job for half the cost, bearing in mind it will be a reduction and change in services but should keep them at a quality level. We educate the client, explaining that the competition can’t do what we were doing for half the cost.”

Examples of maintenance reductions include fewer fertilizations or mowings, fewer major pruning of trees and shrubs, and fewer labor-intensive clean-up services, such as blowing away debris off walkways once vs. three times a week. To make sure the reduction in hours happens for The Greenery’s clients who have reduced services, supervisors or account managers direct foreman, giving them parameters to follow. “If a crewmember used to spend three hours at a property, that will be reduced to two, for instance,” Edwards explains, “and he will maximize the time he’s there and prioritize, weeding out unnecessary extras.”

Commercial opportunities

To know where opportunities lie in the commercial market, contractors have to look property performance in the recession.

Lawn & Landscape research shows gated communities, apartments/condominiums and offices/office parks in the top three spots, with 19, 19 and 18 percent of contractors reporting, respectively.

Looking at the poorest performing properties, retail spaces top the list with 29 percent of contractors reporting. However, offices/office parks and apartments/condominiums also show up in the second and third worst spots, proving location makes a difference in property performance.

Many contractors who are weathering the storm are finding service and client balance mixed with a willingness to adapt to market changes and realities puts them in a stronger position.

Maintenance is one of those services that is saving commercial companies who were heavier into design/build and installation.

D&K Landscape, for instance, was 70 percent design/build and 17 percent maintenance. But a year ago, Garritano made a decision to grow maintenance based on what he was seeing happen in the market, and he’s doubled this service in just seven months. It’s one of the primary reasons the $7 million company is expecting a 14 percent increase in business this year. Today, he’s getting closer to a 50-50 mix between the services and by 2011, maintenance will be the majority of his business. Garritano hopes he beat competitors who are just now jumping on the maintenance bandwagon.

O’Donnell is doing the same with LMI Landscapes. The once 30-percent maintenance business has grown this to 50 percent over the last couple of years.

As the recession deepens, Guido sees more contractors who are starting to “get it,” going from being less prepared to better understanding how to take a position of low-risk, value and uniqueness. “Gone are the days of winging it,” she says. “You can no longer just schmooze a commercial client into using your services. The customer is now too savvy for that.”

The author is editor of Lawn & Landscape. Reach her at nwisniewski@gie.net. Tom Crain, a freelance writer based in Akron, Ohio, also contributed to this story.

Explore the September 2009 Issue

Check out more from this issue and find your next story to read.

Latest from Lawn & Landscape

- LawnPro Partners acquires Ohio's Meehan’s Lawn Service

- Landscape Workshop acquires 2 companies in Florida

- How to use ChatGPT to enhance daily operations

- NCNLA names Oskey as executive vice president

- Wise and willing

- Case provides Metallica's James Hetfield his specially designed CTL

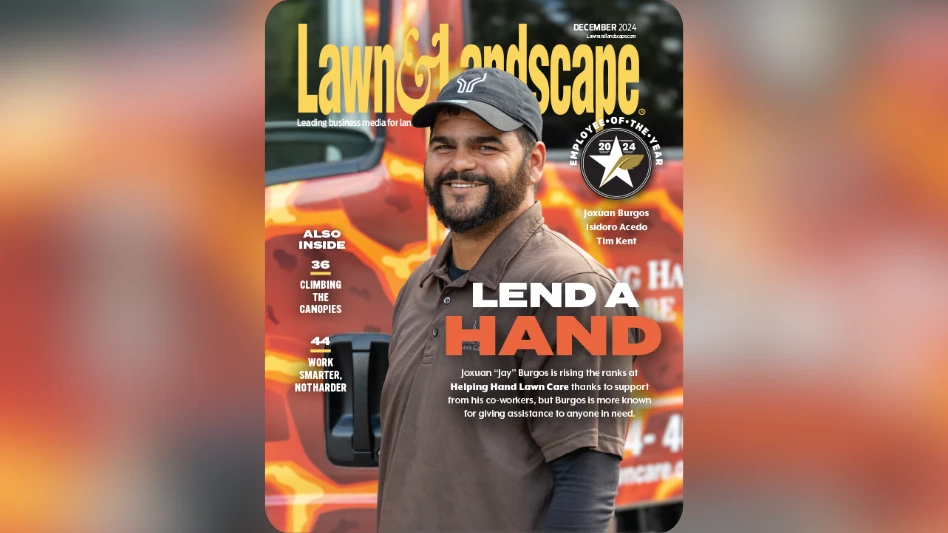

- Lend a hand

- What you missed this week