Based on promotions introduced in late summer, landscape and lawn care professionals may not have to pay for new equipment until April. Now is prime time to buy equipment for the 2010 season, even if the equipment will not “work” until spring. Actually, Jack Snow, president, Sheffield Financial, argues now might be the best time to make a deal – and take advantage of some serious tax breaks.

Based on promotions introduced in late summer, landscape and lawn care professionals may not have to pay for new equipment until April. Now is prime time to buy equipment for the 2010 season, even if the equipment will not “work” until spring. Actually, Jack Snow, president, Sheffield Financial, argues now might be the best time to make a deal – and take advantage of some serious tax breaks.

“Dealers want to reduce inventory before winter, manufacturers are looking for reorders from dealers before spring and financiers want to make loans,” Snow says, describing showroom business. “This means landscape contractors can get good equipment – this year’s models – and not have to make payments until next year.”

Thanks to incentives that began rolling out late summer, you may not have to shell out for new equipment until April. For example, Sheffield Financial offers an installment loan with fixed payments that are due only when the equipment is in use: April to October, in cooler climates.

“You’ll have a much higher payment, but you’ll only be paying for the equipment while it is producing revenue,” Snow says. The company hasn’t offered a program like this since 1993, when serious drought affected equipment sales. Expect other incentive programs to roll out during GIE+EXPO in Louisville, Ky., Oct. 29 to 31.

Meanwhile, buying equipment before year end has tax advantages, adds Snow, a former accountant. Depreciation under Section 179 of the tax code allows businesses to deduct the full purchase price of qualifying equipment purchased or financed during the tax year.

Section 179 makes buying equipment much more attractive than leasing, according to Snow. For instance, leasing equipment with a $10,000 loan and $300 monthly payments means a $3,600 annual write-off. But by buying that $10,000 machine, you can write off the full amount this year.

“If you don’t pay it off, you can still write off the whole purchase price this year and write off interest you make on payments in future years,” Snow adds, advising a discussion with an accountant prior to making capital expenditures.

Buddy Rodgers, president of Buddy Rodgers & Son Professional Lawn Service in Leavenworth, Kan., takes advantage of late-season incentives through dealer from Oct. 31 through December. Last year, he paid 17 percent less for 48-inch and 36-inch mowers.

Sure, purchasing equipment in fall when bids for 2010 aren’t yet locked down can be a gamble. But so is business and life, Snow points out. “We roll the dice every day,” he says.

However, careful equipment purchase planning based on account renewals and conservative projects can give a business owner the workload information needed to justify new purchases now during incentive season.

“Every manufacturer has different programs and promotions,” Snow says.

And if you are concerned about how to pay for what you already have, Snow emphasizes the importance of keeping open communication with your lender and dealer. “We are here to help, not to hurt,” he says.

This month, Lawn & Landscape asked three landscape contractors who operate companies in different revenue categories to reveal their equipment purchasing strategies.

The author is a freelance writer based in Bay Village, Ohio.

Jump To:

Small Business: Less than $500,000

Medium Business: $500,000 to $2 million

Large Business: More than $2 million

Explore the October 2009 Issue

Check out more from this issue and find your next story to read.

Latest from Lawn & Landscape

- LawnPro Partners acquires Ohio's Meehan’s Lawn Service

- Landscape Workshop acquires 2 companies in Florida

- How to use ChatGPT to enhance daily operations

- NCNLA names Oskey as executive vice president

- Wise and willing

- Case provides Metallica's James Hetfield his specially designed CTL

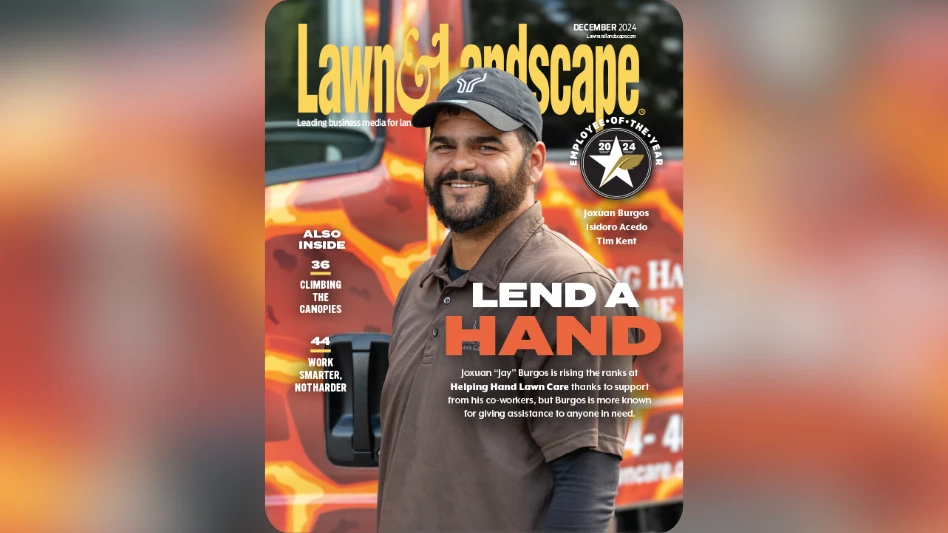

- Lend a hand

- What you missed this week