.jpg) Two years ago, Kinsella Landscaping made a decision to protect its estimated $5 million in equipment by hiring an asset manager, someone to make buying decisions, oversee technicians and, in general, protect the company’s significant capital investment.

Two years ago, Kinsella Landscaping made a decision to protect its estimated $5 million in equipment by hiring an asset manager, someone to make buying decisions, oversee technicians and, in general, protect the company’s significant capital investment.

“We were growing so fast and no one could keep track of all this equipment with two locations,” says Greg Semmer, president.

Repairs were performed incorrectly, and the company had an upset in the service department. Basically, the four technicians were let go and Semmer needed to find someone who could manage the company iron.

“Equipment is expensive, and with growth comes growing pains,” Semmer says matter-of-factly. “We wanted our trucks and equipment to last longer so we could start getting more of a return on our investment.”

In 2008, Kinsella Landscaping grew 30 percent, adding $3 million to its revenue. This year, business is down slightly, underscoring that focus on keeping equipment in tip-top shape. Kinsella Landscaping has four full-time technicians – two at each location – who perform all types of repairs. The cost of paying their salaries and benefits is less than paying a dealership for fixes, Semmer says. In fact, the company has employed at least one full-time technician for 10 years, and hired a part-time mechanic a couple of years after the business started in 1994.

The advantage of managing equipment in-house, and having an asset manager to oversee the company’s fleet, is the ability to track equipment and control expenses.

“The asset manager can look at trends of what is breaking on equipment, and if certain crews or employees have a history of damaging equipment,” Semmer describes. A detailed spreadsheet contains a breakdown of every piece of equipment. The asset manager reviews this document in full every month, updating it when repairs are made or new equipment is purchased.

From a wear-and-tear aspect, Kinsella Landscaping generally purchases new mowers every three to five years.

“But the issue is, we have grown for the last 15 years, so we have always had to buy new equipment to manage that new business,” Semmer says. Semmer knows it costs about $35,000 to outfit one crew. He pencils this amount in the budget, regardless of growth plans. “You never know what will happen,” he says. One time, an employee drove a riding mower into a lake. Last year, three mower engines were destroyed when they were fueled with gasoline that was diluted with water. That repair cost the company $10,000 in labor and parts.

He has admittedly spent too little on equipment in the past. Once, a large contract was delayed and the customer, last minute, asked Semmer if he could take the job. Semmer had to pull together two full crews in three days.

He got it done. “We basically went on a shopping spree,” Semmer says. He maintains a strong relationship with a local dealer and always purchases the same brand of equipment. “If you are consistent with your purchases and you buy in volume, your dealer will start stocking what you want,” he says.

This year, there were no shopping sprees. The company made due with its existing fleet, purchasing about 10 handheld pieces of equipment. Semmer expects to continue conservative purchase habits next year, and he’ll depend on his asset manager and heads of construction, maintenance and overall operations to help him make those decisions.

The author is a freelance writer based in Bay Village, Ohio.

Jump To:

Introduction

Small Business: Less than $500,000

Medium Business: $500,000 to $2 million

Explore the October 2009 Issue

Check out more from this issue and find your next story to read.

Latest from Lawn & Landscape

- LawnPro Partners acquires Ohio's Meehan’s Lawn Service

- Landscape Workshop acquires 2 companies in Florida

- How to use ChatGPT to enhance daily operations

- NCNLA names Oskey as executive vice president

- Wise and willing

- Case provides Metallica's James Hetfield his specially designed CTL

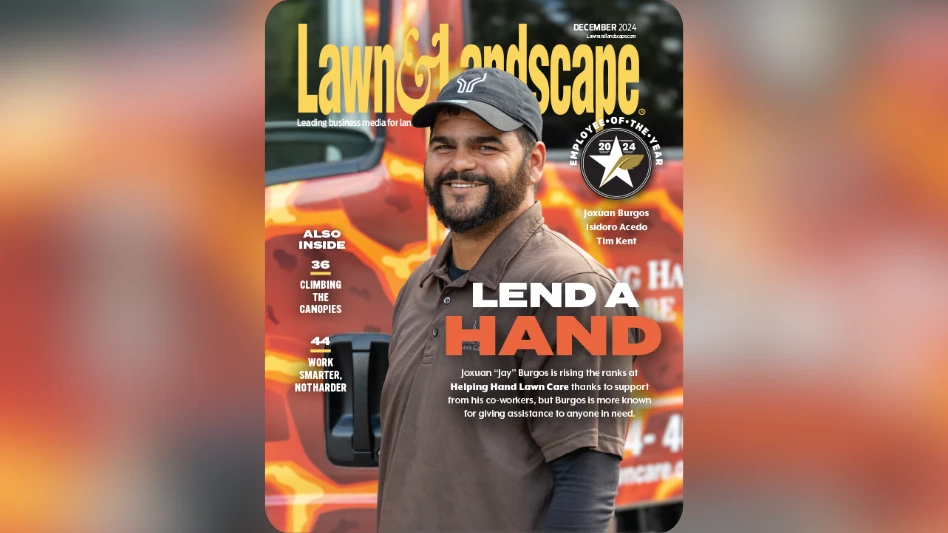

- Lend a hand

- What you missed this week