Christine MayBuddy Rodgers can recuperate a solid 40 percent of his investment in mowers, and his secret is not the color of the iron. It’s keeping careful maintenance records and monitoring each operator’s performance.

Christine MayBuddy Rodgers can recuperate a solid 40 percent of his investment in mowers, and his secret is not the color of the iron. It’s keeping careful maintenance records and monitoring each operator’s performance.

“We keep employees accountable,” emphasizes Rodgers, president, Buddy Rodgers & Son Professional Lawn Service, Leavenworth, Kan.

He does this with a chart that lists each member of his three crews. When an “unnecessary expense” arises – such as a certain $900 repair after a crew planted a zero-turn rider into a wrought-iron fence – that cost is recorded. “At the end of the year when we dole out bonuses, we show employees, ‘This is how much could have been added to your bonus,’” Rodgers relates.

And Rodgers doesn’t skimp on bonuses. Last year, he took his three crew leaders to Las Vegas, all expenses paid. “I have to take care of these guys because they’re the gravy of the company,” he says simply.

In return, his guys better take care of the equipment, allowing Rodgers to market his used machines to the general public. This takes no effort on Rodger’s part. Occasionally, he says, crewmembers are stopped by people who see the yellow and orange fleet and are interested in knowing where they can get a large mower.

“They say, ‘I bought a piece of property with 2 acres of lawn, and that machine would be ideal, what does it cost?’” Rodgers says, imitating how a resale opportunity happens. “We tell them how much the mower costs new, and add, ‘From time to time, we have these for sale and they are in good shape.’”

Because all of his equipment is serviced by the same dealer, to whom Rodgers has been loyal since starting the business 28 years ago, Rodgers has detailed maintenance records. He constantly rotates his fleet and retires mowers once they hit 1,600 to 1,800 hours.

“At that point, they are still running, and they’ll make a good new mower for an individual looking for a commercial machine that can’t afford a new one,” Rodgers says.

Rotating mowers is easy because Rodgers keeps a spare “twin” for every type of mower he runs. His fleet consists of 11 mowers of six different configurations. If one 60-inch zero-turn mower goes down, he has a spare of the same kind.

“Downtime is just critical,” he says.

During heavy-rain weeks when crews have limited time to mow, having those spares is especially helpful. Crews are mowing frantically and machines are more likely to break down.

Rodgers applies the same philosophy to handheld equipment. “The most embarrassing thing is to have a piece of equipment that won’t start while you’re on a property, and you have to play and fiddle with it,” Rodgers says. “If we have to do that with a piece of equipment a couple of times, it’s gone.”

The best equipment investment Rodgers made was ride-on sprayers. He has three of these, one for each crew. “We used to drag a hose around, but now we can produce four times the amount of business,” he says.

The worst purchase decision: a trailer-mounted leaf loader. It seemed like a good idea when the city retired its leaf loaders. Today, Rodgers calls the machine a $16,000 egg. The city replaced its leaf loaders, and Rodgers lost his niche market. Now, he advertises curbside leaf removal “by appointment, not chance,” rivaling the city’s designated leaf pickup days. He uses the machine 10 to 20 percent of the time.

The author is a freelance writer based in Bay Village, Ohio.

Jump To:

Introduction

Medium Business: $500,000 to $2 million

Large Business: More than $2 million

Explore the October 2009 Issue

Check out more from this issue and find your next story to read.

Latest from Lawn & Landscape

- LawnPro Partners acquires Ohio's Meehan’s Lawn Service

- Landscape Workshop acquires 2 companies in Florida

- How to use ChatGPT to enhance daily operations

- NCNLA names Oskey as executive vice president

- Wise and willing

- Case provides Metallica's James Hetfield his specially designed CTL

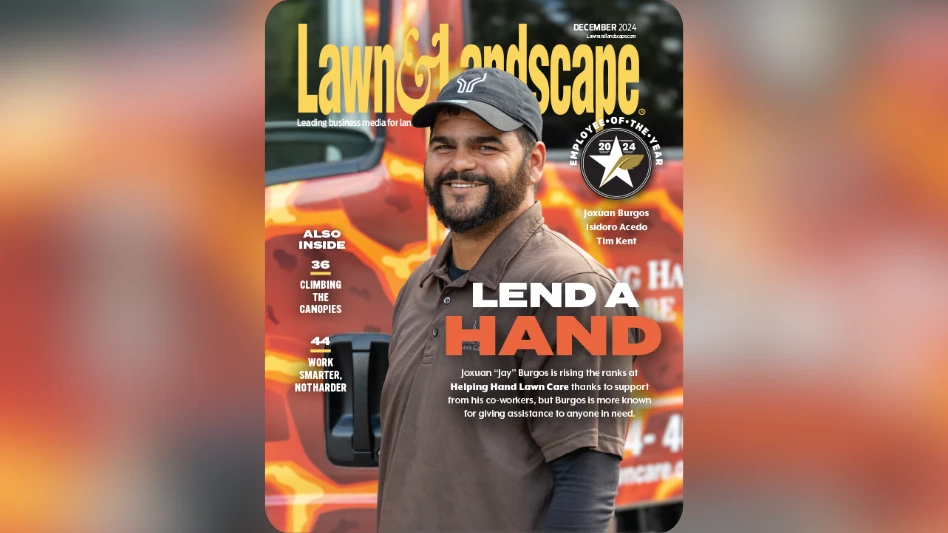

- Lend a hand

- What you missed this week