Small business borrowing is generally not reported on owners’ consumer credit reports unless they fail to pay on time. But with banks facing rising defaults, at least one lender – Capital One – is moving to add small business loans to borrowers’ consumer credit files, meaning small business owners could soon find their business debts are affecting their personal credit, according to a recent BusinessWeek article. Any debt owners personally guarantee – including many business loans and credit cards – could be reported.

Because of the complexity behind credit scoring, it’s hard to predict how the shift will affect any one borrower’s credit score. Tim Klein, spokesman for Equifax, one of the three major consumer credit bureaus, says business owners generally won’t see their credit hurt if they’re current on payments. Borrowers with strong repayment histories could even see scores improve, adds Sharon O’Connor Clarke, a principal consultant with FICO, a credit scoring company.

Lending institutions don’t always tell you all the requirements and where they go to qualify you and your landscape or lawn care business before you apply for financing. A significant step is to pull your personal and business credit.

Fewer than 10 percent of entrepreneurs know about or truly understand how business credit is established and tracked, and how it affects their lives and businesses everyday.

Last month I spoke with a potential client who had questions about his credit situation. He is a typical small business owner in southern California and generates a decent profit.

In the good years he is able to take his family on a trip to Hawaii for a week – something they all love to do. He told me he just applied for a mortgage on a new home and was denied. He started his business three years ago and never had previous credit problems. He couldn’t understand why he was refused since he paid his personal bills on time.

I asked if he had opened any lines of credit for the business in the last three years. He had one line of credit with a bank for $60,000, but nothing else. I then asked if he had received credit or terms to pay suppliers any time since starting the company. “Of course,” he said. Here is where the problem arose. His company needed several suppliers for all of the products he sells. Unfortunately, he applied for credit with each of these suppliers under his personal name during the last year. I asked if he paid all of those bills on time. “Not all the time, but the latest I ever paid someone was 60 days late.”

I cautioned this entrepreneur that obviously not paying bills on time would damage his credit and that there were many other variables that determined his personal credit score. If you want just a simple system to keep your credit in good standing, consider this one simple rule: Make sure your debt load is no more then 25 percent of your gross income, even though many banks will lend at 33 to 38 percent.

Why your credit score is low

FICO, the company previously known as Fair Isaac that develops the formula to determine credit scores, looks at the average statistics of consumers and factors that into business credit scores.

According to FICO, the average consumer will have:

- One inquiry on their personal credit report in a given year.

- 54 percent of credit holders carry a balance of less then $5,000 on all debts other than a mortgage.

- Have access to $12,190 on all credit cards combined.

The entrepreneur, on the other hand, will have several more credit needs than the average consumer. So when the personal credit bureaus compare us to the average consumer, our credit consumption is not normal.

Let’s look at that same specific business situation. This small business client applied several times with suppliers for various credit lines over the last year. Each inquiry will likely drop his credit score approximately five to 10 points. The credit bureaus are supposed to lump three together and only drop five to 10 for the three. He also has a $60,000 line of credit available and carries a balance of $42,000. Both the amount of credit and balance are more then the consumer average, which can hurt his score as well. This is without looking at anything else in his business or personal life.

If this small business owner had just taken the time to develop a business credit profile and start establishing basic lines of credit in the business name and then slowly build the businesses credit over time, he may never have ended up without the ability to buy the home he and his family wanted. This is why entrepreneurs must become like the typical consumer again and separate their personal and business lives.

The author is president of Business Credit Services. Reach him at www.businesscreditbuilder.net.

To learn more about why small business owners don’t have average credit scores, visit www.lawnandlandscape.com/webextras

Explore the October 2009 Issue

Check out more from this issue and find your next story to read.

Latest from Lawn & Landscape

- Our Holiday Lighting Contest rolls on

- LawnPro Partners acquires Ohio's Meehan’s Lawn Service

- Landscape Workshop acquires 2 companies in Florida

- How to use ChatGPT to enhance daily operations

- NCNLA names Oskey as executive vice president

- Wise and willing

- Case provides Metallica's James Hetfield his specially designed CTL

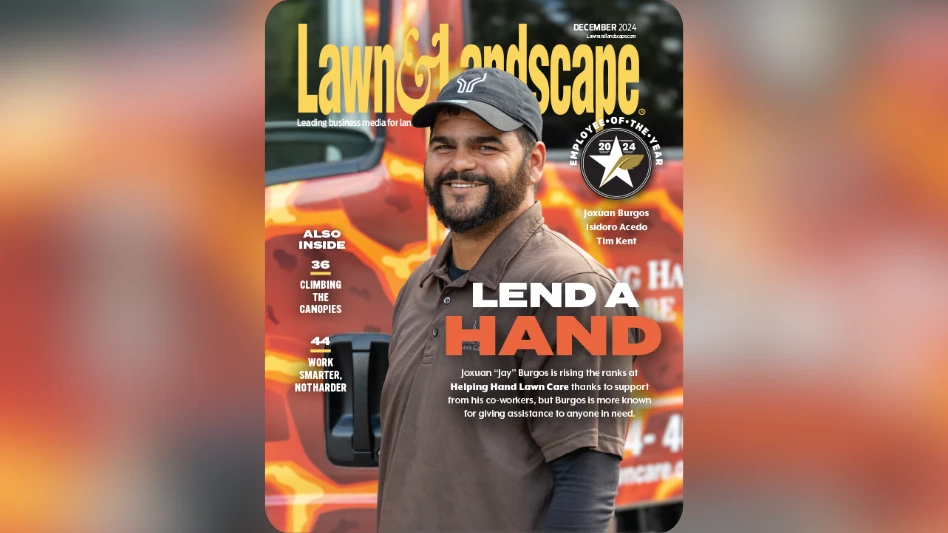

- Lend a hand