©iStockphoto.com/Luca Di FilippoHave you ever mowed a lawn on a snowy January day? Probably not. Most landscapers probably aren’t working in the same capacity during the off-season, so the insurance coverages you carry during peak season should be different than what you carry off-season.

©iStockphoto.com/Luca Di FilippoHave you ever mowed a lawn on a snowy January day? Probably not. Most landscapers probably aren’t working in the same capacity during the off-season, so the insurance coverages you carry during peak season should be different than what you carry off-season.

As you’re wrapping up your season, talk with your insurance agent about off-season insurance coverages. Asking the right questions can help you make sure you save money and stay protected.

Comprehensive-only policies

Season after season, many landscapers are left wondering if they need coverage at all during the off-season. After all, your vehicles are parked, and you probably won’t be driving them again until next spring. You might think it’s better to cancel the vehicle’s insurance during the winter months to save some money, right? Wrong.

A lot can happen to a vehicle in storage, even if it’s covered in a garage, it’s still at risk. Your work truck could be stolen, vandalized or even slightly damaged, and those damages could end up costing more than you might expect. Business owners who want to save some money during the off-season shouldn’t let their vehicle insurance coverages lapse. It’s in your best interest to protect all work-related vehicles, regardless of whether they are in use or not.

Talk to your agent to identify what coverage options are right for you and your landscape business throughout the year. For example, instead of eliminating coverage altogether, seasonal businesses can simply switch over to a comprehensive only policy. This provides basic protection against incidents like theft, vandalism, falling tree branches and windstorms year round.

Another reason to maintain a comprehensive only policy is most insurance companies want to see proof of continuous coverage when you purchase a policy. So, when you drop insurance completely during the off-season, it may seem like you’re saving money in the short term, but when spring rolls around you’ll end up paying more to get the coverage you need. Seasonal businesses can save as much as 10 percent by maintaining continuous coverage throughout the off-season, and it also eliminates the hassle of reinstating your policy each year.

Using work trucks to plow snow

If you’re planning to plow driveways with your work truck this winter, you’ll need to make sure your policy includes liability coverage. Even if you only plow occasionally, maintaining your liability coverage will not only keep you legal, it will protect your business and your vehicle in the event of an accident or other incident.

Bottom line: Talk to your carrier. Your local independent agent will be happy to take the time to review your vehicles, evaluate your specific needs and determine the most cost-effective options for your business. Many offer a variety of coverage options that can help you and your business customize a commercial auto insurance policy to fully protect you when your business is running on all cylinders and when it’s not.

The author is a business auto product manager for Progressive commercial auto insurance. For more information, go to http://www.progressivecommercial.com.

Explore the October 2009 Issue

Check out more from this issue and find your next story to read.

Latest from Lawn & Landscape

- LawnPro Partners acquires Ohio's Meehan’s Lawn Service

- Landscape Workshop acquires 2 companies in Florida

- How to use ChatGPT to enhance daily operations

- NCNLA names Oskey as executive vice president

- Wise and willing

- Case provides Metallica's James Hetfield his specially designed CTL

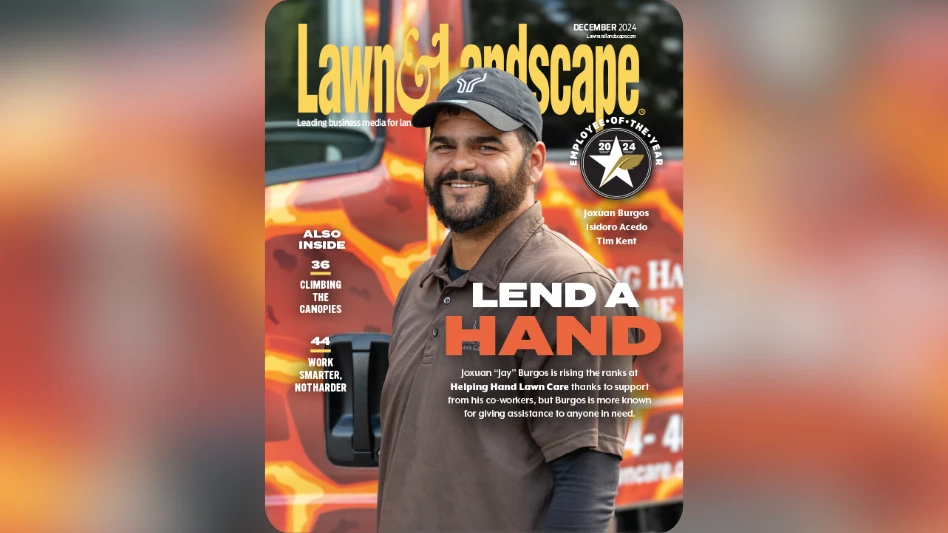

- Lend a hand

- What you missed this week