“Invest in your landscape and it will add 15 percent to the value of your home.”

“Invest in your landscape and it will add 15 percent to the value of your home.”

Sure, the first time a homeowner hears this research it sounds pretty good. It presents a sound investment strategy, emphasizing a service that keeps giving back, particularly today as home values have diminished.

The problem? Everyone in the industry is using it, fighting to grab a greater share of existing and dwindling demand. They are all vying for the same 35- to 55-year-old Baby Boomer customer.

The problem with this sales tactic? “It’s already old thinking,” explains Jim McCutcheon, CEO and partner, HighGrove Partners, Austell, Ga. And that thinking is even more dangerous in today’s troubled economy. “The vast majority of the world doesn’t think their equity is coming back any time soon. In fact, if you use this sales tactic on a homeowner today, they’d probably laugh at you.”

Since technology has advanced rapidly, and information is available at the click of a mouse, the typical landscape customer is much more educated. Contractors who aren’t planning ahead may fall behind. “Too many small business owners in this industry think in the ‘now’ mode,” observes Russ Frith, president and CEO of Lawn Doctor, Holmdel, N.J. “Their energies are so consumed with doing the things necessary to make a dollar today that they forget about tomorrow.”

The current economic struggle has added an additional twist – knowing the little nuances about a business’ typical customer can mean the difference between growth and death, particularly when every penny means so much more.

The basics of understanding a customer stem from comprehending their core values, and a lot of that can be determined through looking at their generational characteristics and resulting future wants vs. needs.

| Generation | 2008 | 2009 | % Change |

| Baby Boomers | $98 | $64 | -35% |

| Generation X | $110 | $71 | -35% |

| Generation Y | $92 | $61 | -34% |

As any salesperson has probably heard before, the first rule of selling is simple and steadfast: Know your customer. “With three distinct generations playing active roles in the buying decisions of companies, that tenet is increasingly difficult to fulfill,” explains Cam Martson of Mobile, Ala.-based Generational Insight. “It is no longer enough to be personable and knowledgeable about your service. To succeed in today’s business climate, you need to approach each buyer with an informed generational perspective – recognizing the underlying biases, values and expectations that pave the way to ‘yes.’”

Boom Town

Who wouldn’t want to fight for the Baby Boomer customer? They have an almost insatiable desire for real estate and appreciate housing as a great investment. In fact, they own and buy more real estate than not only any other generation, but also more than the national average. According to a National Association of Realtors September study, one out of four Baby Boomers own more than one property. The same survey also revealed the natural beauty of the environment they live in is on their list of top eight things they feel make the perfect retirement location – meaning landscaping is right up there with quality health care.

The NAR survey also shows that one-quarter of Boomers aren’t satisfied with their present homes, meaning a good portion of them may be considering a move – presenting additional opportunities for landscape renovation and installation.

Terry Kurth understands this demographic. His typical customer is between the ages of 35 and 54, lives in a two-income family with children and has a new home or one that is less than 20 years old. “They’re both working and busy – they like frequent contact with us and to build a relationship,” explains the subfranchisor/career consultant of Weed Man, who runs the $2 million franchise in Madison and Milwaukee, Wis. “For Baby Boomers, their single biggest asset is still their home, and so their mentality is they want to put a better moat around their castle. If they show their home is receiving care on the outside, they know potential buyers will expect the same inside.”

Source: Gallup Poll

Source: Gallup Poll

However, this customer is becoming harder to reach than in years past. With telemarketing and direct mail that got a 2 percent response rate and closed 55 to 60 percent, the cost to acquire a customer used to be in the $40 to $60 range for Kurth’s business. With 87 percent of his area on “do-not-call” lists, direct mail response rates down below 1 percent, postage costs rising and closing percentages dwindling, today’s cost to acquire a customer is now more than $100, Kurth says.

On top of that, the current economy has decreased overall spending. What was once 73 or 74 percent of GDP is now 69 to 70 percent of GDP, each percentage point representing about $900 billion, Frith shares from recent reports he’s read.

Start by looking at Baby Boomers. Some experts attribute the sustained economic growth of the 1980s and 1990s, which the landscape industry certainly enjoyed, to the fact that Baby Boomers reached their peak earning and spending years during this period. As they near retirement age, the concern is they will pull back spending to make up for nest egg losses they suffered the past year. Gallup poll data suggests Boomers have already pulled back – this year, their daily spending of $64 is down from an average of $98 last year.

But they are not alone in pulling back on their consumption. While Boomers sheer numbers make their influence on the national economy greater than that of any other generation, their average reported spending is actually lower than that of Generation X. In 2009, average reported daily spending among Gen-Xers is $71 compared to Boomers’ $64. Last year, the figures were $110 and $98, respectively. Higher spending among Generation X is not a function of greater income, as the two groups have similar income distributions.

| Generation | Years | Population |

| The Silent | $98 | $64 |

| Baby Boomers | $98 | $64 |

| Generation X | $110 | $71 |

| Generation Y | $92 | $61 |

The most likely reason for the difference is that 71 percent of Gen-Xers have children under 18, according to Gallup estimates. The presence of young children in the household can be a major predictor of reported spending (in 2008 and 2009, the difference in reported average spending between parents with children under age 18 and non-parents was about $20, Gallup shows). By comparison, only about one in four Baby Boomers have children under age 18.

Also notable in the data is the fact that reported spending by Generation Y thus far in 2009 ($61) is roughly on par with that of Boomers. This is the case even though Generation Y’s reported income is quite a bit lower on average than Boomers’.

Beyond Generational Divides

Based on this spending data and future predictions, many think consumer spending can no longer carry the economy. “It’s not clear how much the economy can grow unless spending increases from its current low levels,” Gallup poll data reports. “But spending may not necessarily be the best course of action, particularly for Baby Boomers as they approach retirement age and prepare to rely on Social Security and their retirement savings as primary sources of income. Retirement-age Americans consistently show the lowest levels of reported spending.”

Amidst all this uncertainty and change, what should a landscape contractor do to attract new customers? Appreciate the generational differences that will change how they market and approach customers, but look for bridges from generation to generation that are universal, experts suggest.

First, regardless of generation, “no one has patience anymore,” McCutcheon says, listing speed as one of his two criteria that go across all generations. “The days of apologizing for being last minute are over. You have to anticipate your customers’ moves and stay ahead of the game.

“The best thing you can do is call them up and ask, ‘What can I do for you?’” McCutcheon advises. HighGrove Partners tries to have more communication going out than coming in to stay ahead of this curve and lessen customer impatience and complaints. “We have good and bad days with this, but the day we do it consistently we will win.”

This includes commercial customers. “I don’t think a 30-year-old property manager is any different from a 50-year-old property manager,” explains George Gaumer, vice president/general manager of Kent, Ohio-based Davey Commercial Landscape Services. “They all want instant response. You can’t expect for them to leave you a voice mail and wait to get a call back. Voice mail is now a distant second to e-mail.”

This includes commercial customers. “I don’t think a 30-year-old property manager is any different from a 50-year-old property manager,” explains George Gaumer, vice president/general manager of Kent, Ohio-based Davey Commercial Landscape Services. “They all want instant response. You can’t expect for them to leave you a voice mail and wait to get a call back. Voice mail is now a distant second to e-mail.”

To appease this client demand over the past three years, all Davey account managers have been equipped with Blackberries so they can communicate instantly with their customers. “If you don’t have e-mail access more frequently than at the end of the day and don’t already have updated Blackberry or mobile technology, you need to think about it now.”

The other important customer desire that stretches beyond generational divides is return on investment. “You have to be stewards of their money,” McCutcheon says. “What do they need? In every crisis, there’s an opportunity.”

In McCutcheon’s case, he noticed developers he worked with were all devastated by the economy. They have all let go of their staffs. “So what we’ve done is developed a land services company,” he shares. “We expanded what we do with our landscape architects and brought on a former developer. Now we can be an adjunct staff for developers so they don’t have to hire people.”

The company is already getting work as a result of this investment – McCutcheon says the group has secured four projects. “A developer isn’t going to make money again until they develop something. People will develop again – maybe not tomorrow but they will,” he says. “If we position ourselves now as experts and put ourselves in the right spot, once that turnaround comes, we’ll be in the right position.”

Another way to stay ahead of customer need is to set up a customer advisory council, McCutcheon suggests, which HighGrove did four years ago. It’s made up of seven customers who are each invited to serve a 12-month term. They provide direct and ongoing customer feedback for the company, participating in two to four lunch meetings annually that are each two to three hours long. HighGrove treats the group to lunch.

“Too often, we focus on what we think we do well and what we think customers want delivered,” McCutcheon says. “Before we started this council, there were things we had been doing for years that I thought our customers loved, and when I finally asked them about it I found the opposite was true. Without this council, I would never figure out what our customers needed, especially in this uncertain economy.”

What Should You Do?

Start working on a broader array of services and capabilities than just landscaping. What the generational divides have taught sellers is that customers are expecting more speed, capability and flexibility than ever before. “So now you have to do more than just be a landscape company,” McCutcheon stresses.

A solutions provider might be a better description, according to Bill Poppei, professor emeritus of finance at Chicago’s DePaul University. “Instead of putting in a landscape, appeal to these high-tech, advanced customers and put in an intelligent landscape,” he says. “This would be one that uses tools to tell you when they are hurting, e.g. need water. There are sensing devices you can use now to sell this niche.”

McCutcheon laughs remembering a relevant story he recently told his sales team. He was asked to give a motivational speech and found himself staring at the old and new iPods he had sitting on his desk. “Apple created something I didn’t even know I needed with the first one, and then two or three years later they did it again,” he says.

Unfortunately, “there is little innovation in the landscape industry – period. So maybe innovation isn’t looking at what we do or the way we build or maintain it, but maybe it involves more of how we redefine the landscape.”

For instance, everyone knows water is a problem today, and one that will continue. Two years ago in September, a drought in McCutcheon’s market turned off the water. That’s the same year he launched the company’s KnowWater program – more than tripling its irrigation business in a year when other companies shut their doors. “We spoke the customers’ language, understood their pain points, and it worked for us.”

Boomer savings rates remain high – about 20 percent of their income at age 50, according to the Bureau of Labor Statistics Consumer Expenditure Survey, and this has only increased in today’s economy. Where will that money go? You decide.

| BABY BOOMER |

| Baby boomers are “aging by the minute as they worry about retirement and savings,” describes Drew Stevens, president of Stevens Consulting Group, a sales consulting firm. “This group resists spending during economic uncertainty since they pay with cash not credit. To achieve sales excellence it is imperative for selling professionals to create a bond with Boomers.” Steve Howard, author of Boomer Selling, adds these tips about Boomers:

|

| GENERATION X |

This generation is very open to technology yet its members are also well educated – if they need information they know where to get it, so selling professionals need to illustrate differentiation, Stevens advises. “Generation X wants issues resolved expediently and deplore lengthy sales pitches in favor of solutions,” he says. This generation is very open to technology yet its members are also well educated – if they need information they know where to get it, so selling professionals need to illustrate differentiation, Stevens advises. “Generation X wants issues resolved expediently and deplore lengthy sales pitches in favor of solutions,” he says. According to Brand Channel, Generation X consumers are more cynical than their predecessors – they want to carefully evaluate their choices and reach their own purchasing decisions. This discriminating pattern often discourages brand loyalty. “Target Gen-Xers by trying to convince them other Gen-Xers are doing the same thing – something they can join and to which they can belong,” Brand Channel advises. |

| GENERATION Y |

The largest and most influential group of purchasers since the Baby Boomers, Generation Y is on the minds of many selling and marketing professionals. “They are influential, have the money to spend and there are many of them,” Stevens says. “They are very well educated. As a group, they believe in real time connection with the Internet – a must medium. They are all about instant connectivity and, most importantly, instant gratification.” The largest and most influential group of purchasers since the Baby Boomers, Generation Y is on the minds of many selling and marketing professionals. “They are influential, have the money to spend and there are many of them,” Stevens says. “They are very well educated. As a group, they believe in real time connection with the Internet – a must medium. They are all about instant connectivity and, most importantly, instant gratification.”Being the most tech-savvy of the average household, they are frequently tapped for opinions in family purchasing decisions, adding to their already considerable influence in the marketplace, Brand Channel reports, adding that they are easier targets because they grew up in a culture of pure consumerism. Get their vote, and likely the other two generations will follow. They are also less fearful of taking a risk on something they believe in. However, remember that “they want to be treated with respect and not condescended to as know-nothing kids,” Brand Channel advises. “They want to be listened to and have their needs and expectations addressed.” Take a page out of Apple’s or Southwest’s playbooks and build services with advice from this group. |

The author is editor of Lawn & Landscape. Reach her at nwisniewski@gie.net.

Explore the October 2009 Issue

Check out more from this issue and find your next story to read.

Latest from Lawn & Landscape

- Our Holiday Lighting Contest rolls on

- LawnPro Partners acquires Ohio's Meehan’s Lawn Service

- Landscape Workshop acquires 2 companies in Florida

- How to use ChatGPT to enhance daily operations

- NCNLA names Oskey as executive vice president

- Wise and willing

- Case provides Metallica's James Hetfield his specially designed CTL

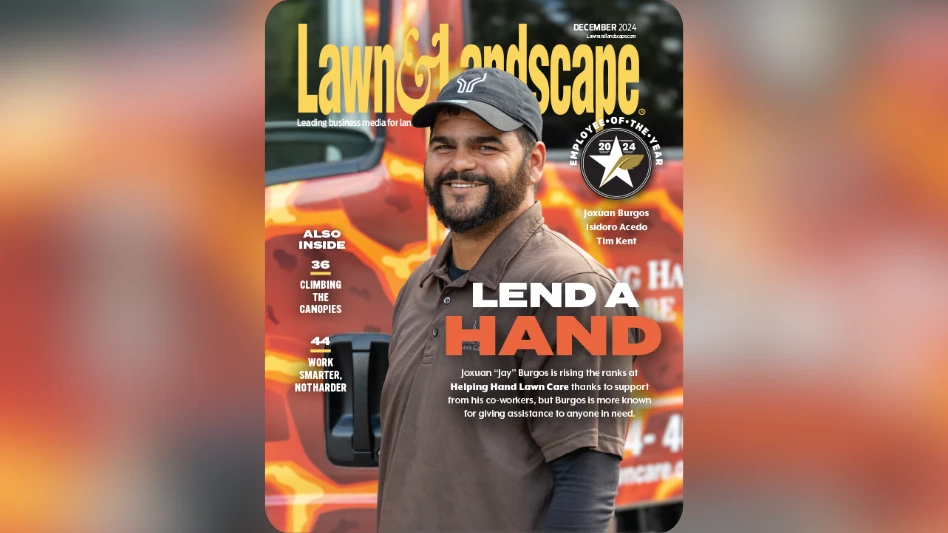

- Lend a hand