.jpg) There are two types of costs – direct and indirect.

There are two types of costs – direct and indirect.

Direct costs are also called “variable costs” and refer to costs that are a direct result of performing your landscape or lawn care service. Examples of these are materials and labor needed to provide the service.

Indirect costs are also called “fixed costs” and refer to expenses your business will have regardless of sales volume. Examples of these are rent, utilities, wages that are not based on commission, interest expenses, advertising, vehicles, etc. The tricky aspect of these are that a cost may increase with increased sales, e.g. an increase in sales may require overtime or the addition of staff but the relationship is not direct.

A good tool for managing direct and indirect costs is to monitor the costs on your monthly income statement as a percentage of sales. Divide the cost by total sales.

Direct costs as a percentage of sales will remain within a narrow margin. For instance, if materials costs are typically 30 percent of sales, then when the actual dollar amount of materials used to perform more services goes up, as a percent of sales, it will remain close to 30 percent. What would lower the percentage is if you got a better deal from your supplier.

Your indirect costs when monitored as a percentage of sales will respond differently. For example, $500-a-month rent remains $500 per month even if your sales increase to $5,000. $500 divided by $1,000 in sales equals 50 percent. $500 divided by $5,000 in sales equals 10 percent.

This provides you with a two valuable management tools – break-even analysis and your contribution margin. Break-even analysis helps quickly determine if a solution is feasible. Contribution margin is the remaining profit after direct costs are taken out of a sale. For example, if you sell a bookcase for $250 and it cost you $75 to make, your contribution margin is $175, or 70 percent. The contribution pays for all the fixed expenses/overhead.

A good way of organizing these costs is to put all the direct costs in the “cost of goods” section and the indirect costs in the expense area of your income statement. By doing this, gross profit equals contribution margin and is automatically calculated for you.

Identifying your direct costs also helps you bid in a competitive environment. Imagine you know you have covered your overhead expenses for the month with normally bid projects and a job comes up for bid around the 15th of the month. You figure it will be very competitive and if you use your usual estimating process on it, you will not get the project.

Since you have already covered all of your expenses for the month and any margin above your direct costs is profit. You can then aggressively go after the project with a bid slightly above your direct costs.

The author is the CEO of CORE Magazine.

Explore the October 2009 Issue

Check out more from this issue and find your next story to read.

Latest from Lawn & Landscape

- LawnPro Partners acquires Ohio's Meehan’s Lawn Service

- Landscape Workshop acquires 2 companies in Florida

- How to use ChatGPT to enhance daily operations

- NCNLA names Oskey as executive vice president

- Wise and willing

- Case provides Metallica's James Hetfield his specially designed CTL

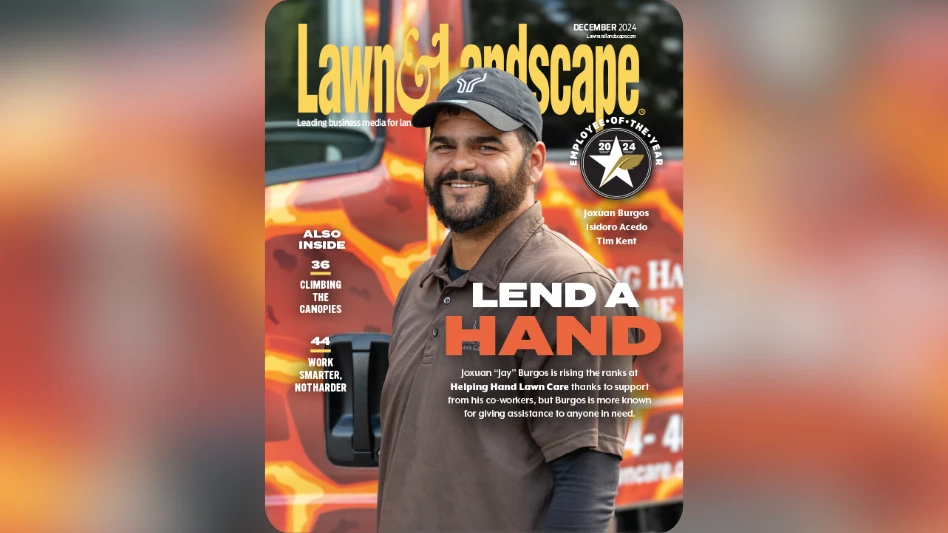

- Lend a hand

- What you missed this week