©iStockphoto.com/MBPHOTOIt’s no wonder consumer confidence ranked No. 1 on the average landscape contractor’s list of economic challenges they would choose to fix if given the chance in 2010. Seventy-eight percent of contractors said clients reduced services/spending this year and 72 percent said clients cancelled services this year. As a percentage of revenue, this amounted to 11 and 7 percent on average, respectively.

©iStockphoto.com/MBPHOTOIt’s no wonder consumer confidence ranked No. 1 on the average landscape contractor’s list of economic challenges they would choose to fix if given the chance in 2010. Seventy-eight percent of contractors said clients reduced services/spending this year and 72 percent said clients cancelled services this year. As a percentage of revenue, this amounted to 11 and 7 percent on average, respectively.

And economic data support what contractors are seeing out there. The latest Census report shows damage done to U.S. households by the recession. “Poverty rose, incomes fell … even more disconcerting, the Census data suggest households are at best no better off financially than they were a decade ago,” says Mark Zandi, chief economist and cofounder of Moody’s Economy.com.

The most telling statistic is the nearly $2,000 decline in real median household income to just more than $50,000 last year (in 2008 dollars), Zandi says. “This was the largest decline in the 40 years that Census has been doing this calculation … the decline is representative of households’ severe financial stress. Real median incomes have fallen all the way back to where they were in the late 1990s.”

This affects residential landscape sales most. Contractors reported a drop in their average annual sales that came from single-family residential customers, from 63 to 61 percent. What has increased in its place are commercial/industrial and multi-family structures – going from 25.2 to 26.4 percent and 6.4 to 7.4 percent, respectively, from 2008 to 2009. Government/institutional work remained the same at 4.1 percent.

This affects residential landscape sales most. Contractors reported a drop in their average annual sales that came from single-family residential customers, from 63 to 61 percent. What has increased in its place are commercial/industrial and multi-family structures – going from 25.2 to 26.4 percent and 6.4 to 7.4 percent, respectively, from 2008 to 2009. Government/institutional work remained the same at 4.1 percent.

In addition to incomes shrinking, debt loads are also heavy, weighing on lower- and middle-income households most. “Many of these households borrowed heavily earlier in this decade because they thought they were growing wealthier as their homes appreciated and to supplement constrained incomes,” Zandi reports. “The record high and rising number of consumer defaults and foreclosures is the result of these high debt service burdens.”

For the higher income Americans, the problem is vanishing nest eggs. According to the Federal Reserve’s “Flow of Funds” report, household net worth (the difference between household assets and liabilities) has dropped by $14 trillion since peaking nearly two years ago. Housing wealth is off about $5 trillion from its peak, stocks have lost nearly $6 trillion and other assets have fallen by $3 trillion.

This all means consumers are no longer in a position to power the U.S. economy, Zandi says. “With incomes under pressure, debt loads overwhelming and nest eggs diminished, it will be difficult for consumers to simply do their part in contributing to economic growth.”

The good news for landscape and lawn care professionals is that even with diminishing funds, busy Americans still value landscape services – basic maintenance and tree care rose above the others this year, showing 2009 net percent growth at 6.3 and 7 percent, respectively.

The reason? Residential customers who are more overworked in today’s economy than in the past still value their time, and look at landscape maintenance as a small expense compared to others they may consider cutting. And, they view it as a service that adds value to homes they may want to sell in the future. This year, with home values diminishing, homeowners want to do everything they can to boost worth.

Commercially, keeping vacancies down and tenants happy is something to which property maintenance contributes. Basic maintenance is a requirement, while enhancement services like seasonal color are being cut back in order to save some money on overall property aesthetics.

When contractors were asked which services their companies offered, many categories remained just slightly up while others jumped more considerably and are worth noting, including all irrigation services, some turf maintenance services – aeration, hydroseeding, turf weed and disease control; waterscapes, retaining walls and other hardscapes; and a few tree care-related services, including installation, fertilization, and insect and disease control. Product purchases correspond with these trends.

|

Confidence State-by-State

|

The author is editor of Lawn & Landscape. Reach her at nwisniewski@gie.net.

Latest from Lawn & Landscape

- Our Holiday Lighting Contest rolls on

- LawnPro Partners acquires Ohio's Meehan’s Lawn Service

- Landscape Workshop acquires 2 companies in Florida

- How to use ChatGPT to enhance daily operations

- NCNLA names Oskey as executive vice president

- Wise and willing

- Case provides Metallica's James Hetfield his specially designed CTL

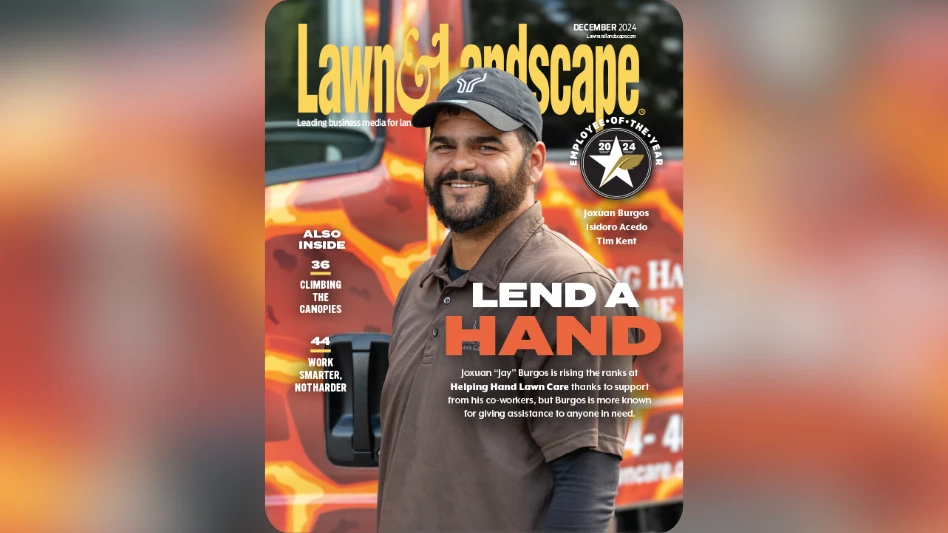

- Lend a hand