|

Causes for Concern The top 10 concerns landscape contractors have about business in 2010 are:

|

No one has ever said landscape and lawn care business owners weren’t a confident, optimistic group. And during a challenging year like 2009, that confidence is playing a big role in how these contractors are reacting to economic pressures and business challenges.

Approximately 87 percent of contractors are confident the landscape industry will rebound in 2010 compared to 78 percent last year, with 32 percent of them feeling very confident (also an increase from last year’s 25 percent).

Only 10 percent of landscape contractors lacked confidence going into 2010, down 5 percent from last year. This coincides with national small business figures. According to Discover Small Business Watch’s August survey, economic confidence among small business owners jumped to its highest level in 18 months, and 30 percent of small business owners see economic conditions for their businesses improving.

The National Federation of Independent Business September survey reported small business optimism rose for the third time in the last five months, and this is also consistent with the steady increases happening in Moody’s Economy.com’s weekly survey on business sentiment.

And, finally, more than half (55 percent) of entrepreneurs have an optimistic outlook on near-term business prospects, up from 45 percent in March 2009, according to the American Express OPEN Small Business Monitor’s September survey. One quarter (26 percent) even report expanding opportunities for their businesses, up from 15 percent one year ago.

One reason for businesses’ more upbeat view is the quickly improving profit picture. Decelerating compensation growth, combined with strong productivity growth, is leading to falling unit labor costs and high profit margins – one reason to expect an improving trend in profit growth, along with GDP growth and a better revenue picture, according to Aaron Smith, a senior economist for Moody’s Economy.com.

“Improving profits and revenue give firms a signal to start hiring and investing,” Smith explains. “This is important since slower wage growth, while positive for profits, is negative for households. It is also important to realize that wage growth is not the same thing as household labor income growth, as the latter also depends on hours worked. Thus, the pickup in GDP helps labor income strengthen even in the face of slowing wage growth. This is starting to happen, with the rise in earnings thus far this quarter nearly matching a smaller drop in hours worked, implying stable total wage income.

“This is how a virtuous circle begins,” Smith continues. “As labor income grows, it provides a sustainable base for consumer spending and makes it less dependent on support from the government stimulus. This circle is becoming more entrenched as the manufacturing rebound and the recovery in financial conditions gather steam, reinforcing our view that growth can be sustained in 2010.”

Moody’s Economy.com chief economist and cofounder Mark Zandi agrees with Smith.

“Business sentiment generally reflects economic conditions and does not drive them, save at turning points in the business cycle,” Zandi says. “Recessions occur when businesses lose faith that their customers will purchase what they produce; they respond by cutting their investment and payrolls. Recoveries begin when that faith is restored.”

|

Focus on Service Businesses Today, owners of service businesses like landscape contractors are more optimistic than their manufacturing and retail counterparts. Fifty-eight percent maintain a positive outlook vs. only 51 percent of manufacturers and 47 percent of retailers, according to the American Express OPEN September Small Business Monitor. Here are some other ways service businesses compare to their manufacturer and retail counterparts:

|

The author is editor of Lawn & Landscape. Reach her at nwisniewski@gie.net.

Latest from Lawn & Landscape

- Our Holiday Lighting Contest rolls on

- LawnPro Partners acquires Ohio's Meehan’s Lawn Service

- Landscape Workshop acquires 2 companies in Florida

- How to use ChatGPT to enhance daily operations

- NCNLA names Oskey as executive vice president

- Wise and willing

- Case provides Metallica's James Hetfield his specially designed CTL

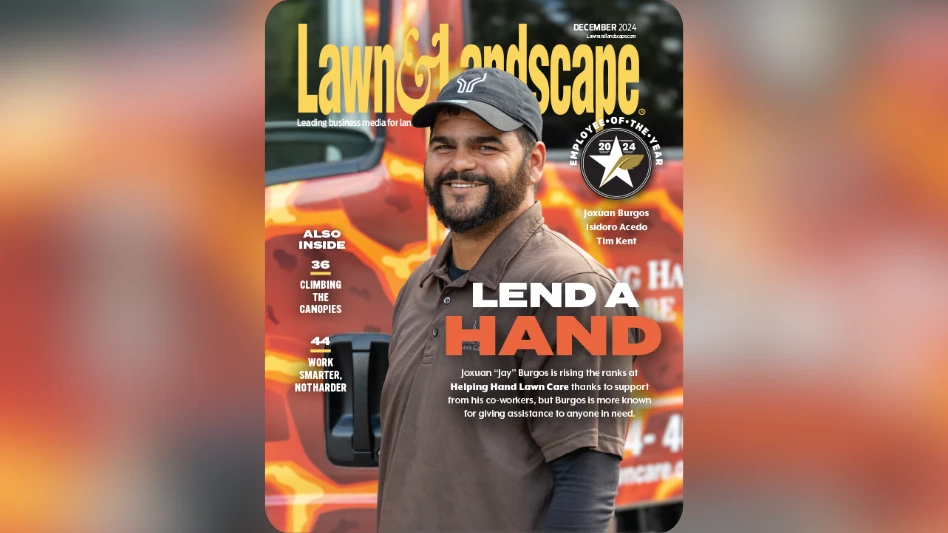

- Lend a hand