Imagine presenting a $12,000 landscape job to a couple who loves your ideas. Unfortunately, their budget doesn’t and the project stalls. Setbacks like this happen. But, good leads don’t have to end this way.

Solve for Project Setbacks

Customer financing, a relatively new idea in landscaping, helps solve problems contractors face every day … scaled-down projects, cancelled projects, and larger jobs split into smaller phases spread over several months or years.

To overcome these income-hindering setbacks, some landscape contractors offer their customers financing options to pay for their outdoor improvements over time. With this flexibility, contractors have seen on-the-fence leads turn into revenue-generating work.

Financing Shown to Grow Revenue

Lawn & Landscape’s 2014 survey about finances supports that. According to the survey, more than 38% of the contractors who offer financing said their cash flow improved, roughly 33% got more customers, and nearly 30% were able to increase the size of jobs.

“[Financing] has allowed Meadows Farms’ customers to be comfortable doing phases of their landscape projects that would typically be undertaken after another year or two, and sometimes never. There is no doubt that we’ve gained sales ...”Dave Reed, Meadows Farms, Inc.

More Contractor Benefits

Having a good consumer finance program in place can lead to other major business benefits, too, including:

- Competitive market advantage

- Customer purchasing power

- Flexibility and affordability to move larger-scale projects forward

- Fast credit decisions allow work to start immediately for approved customers

- Consistent income for completed jobs (funding typically within 48 hours)

- Customer loyalty

Choosing the Right Program

When a financing program for customers seems like the right business move, contractors should carefully consider the options and look for a program with:

- Good support systems

- Consistent and competitive contractor discount rates

- Initial training with ongoing resources

- Easy application and transaction processes

- Solid reputation and strong experience

Contractors recommend customer financing from Wells Fargo

Among existing programs, Parker Homescape found the right fit with the Wells Fargo Outdoor Solutions Visa® credit card program.

With average financed amounts from Wells Fargo ranging from $10,000 to $12,000 – 250% to 300% higher than a $4,000 average size job – their program offers contractors consistent, competitive discount rates and seasonal promotions.

“The Wells Fargo Outdoor Solutions program has been a strong sales tool that has helped us generate new business and provides our customers with more purchasing power to complete their projects. The program has been a great help in boosting revenue.”Scott Parker, owner of Parker Homescape

Wells Fargo sales development consultants say program enrollment is easy for landscape design businesses, and they’re quickly up and running. Mobile, online, and paper options make it easy for contractors to submit applications, and immediate credit decisions mean there’s little, if any, waiting.

Also satisfied, Pacific Outdoor Living touts the program’s benefits, including simplicity and strong customer credit limits.

“The Wells Fargo Outdoor Solutions program … has also given us a tool to ‘fast track’ some projects. The online account application process is simple and very fast, and we’ve had great success in getting adequate credit lines established for our clients.”Matthew Shepherd, Pacific Outdoor Living

Theresa P. from Synscapes of New Mexico echoes Shepherd’s positive experience.

“The Wells Fargo Outdoor Solutions credit card program has allowed us to offer financing options for our customers. Wells Fargo has been easy to work with and … our customers are always pleased at how quick the credit application process is.”

Wells Fargo Outdoor Solutions Geared Toward Landscaping

With its Outdoor Solutions program, Wells Fargo fills a void in landscaping. Contractors can depend on the program from a recognizable national brand known for its financial stability and exceptional service levels with more than 50 years of consumer finance experience.

“No one else has a program geared toward landscaping that even comes close. I don’t think we have ever had such a high [approval] rate with other programs … Our business has increased thanks to this valuable Wells Fargo Outdoor Solutions program.”Victoria Smith, Bailey Construction & Landscape Group

Learn more. Enroll Today!

Join these contractors in offering the Wells Fargo Outdoor Solutions Visa® credit card program. For more information and to enroll, call 1-866-840-9445, Monday – Friday, 7:30 a.m. to 5:30 p.m. Central Time or visit wellsfargo.com/outdoorsolutions.

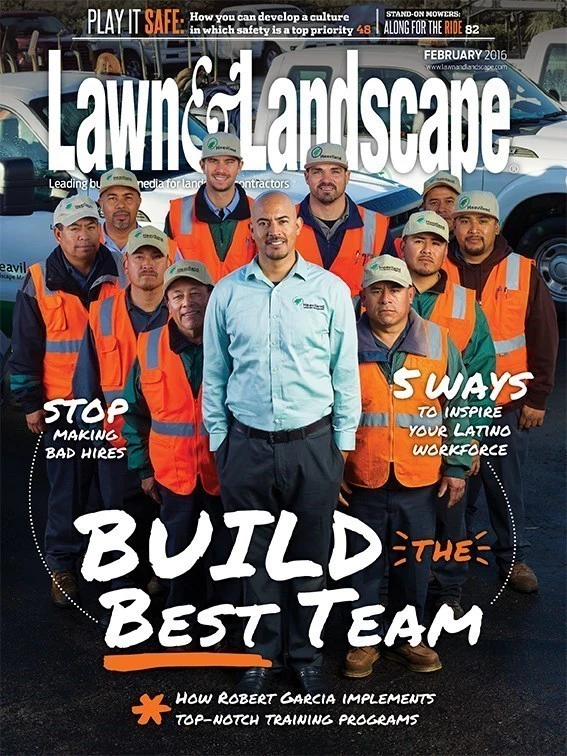

Explore the February 2016 Issue

Check out more from this issue and find your next story to read.

Latest from Lawn & Landscape

- Project EverGreen helps revitalize Milan Park in Detroit

- Trex Company wins Product of the Year, Judges’ Choice Winner at Environment+Energy Leader Awards

- General Equipment & Supplies in Fargo adds Takeuchi equipment

- Mariani Premier Group acquires Hazeltine Nurseries

- EnP Investments adds Mark McCarel as Northeast territory sales manager

- Our April issue is now live

- Ready or not

- Tribute to an industry guru