Just last week in an estimating workshop I was conducting, I was asked one of the most frequent questions that I get. It goes like this: “Given the size of my company, how much money should I be taking out of my business?”

We need to recognize that there are two competing realities when addressing the issue of owner’s pay. First is the federal tax code and its regulations. Second is market reality with its concept of fair market value (FMV) and the need to be competitive in an open market.

I tell clients that my job is to help them make as much money as possible. Their CPA’s job is to make it look like they’re going broke and keep them out of jail.

Fair market value.

FMV is defined as the “price at which an asset or service passes from a willing seller to a willing buyer. It is assumed that both buyer and seller are rational and have a reasonable knowledge of relevant facts.”

When teaching contractors in my estimating workshops how to prepare an estimating budget, I explain to them that we will use the concept of FMV to determine many of our costs. I further explain that we will ignore (not violate) tax regulations for such items as depreciation, spouse’s salary and vehicle, rent, owners’ salaries and dividends, to name a few. While tax-driven expenses may be real, they are not necessarily realistic.

For instance, spouses often are paid an inordinately high salary for minimal work performed in the company. This is not an FMV salary, it is tax driven. For such a person, my estimating budget would include spouses’ salary based on actual hours worked multiplied by a realistic (FMV) hourly wage.

Green industry benchmarks are germane to our discussion. First, general and administrative (G&A) overhead costs for a typical green industry company normally run about 25 percent of sales. Second, wages for owners and office personnel included in G&A overhead costs should be no more than 12 percent of sales.

Calculating the pay package.

I include three categories in my estimating budget for owners’ pay. Two are determined by fair market value: field pay and G&A overhead salary. The third, dividends, is determined by an owner and his/her CPA. Dividends are not calculated using FMV. Rather, dividends are somewhat arbitrary and are determined by the tax code and the profitability of the business.

Field pay for owners is their remuneration for such things as design time, field supervision, actual work performed on jobs, etc. I calculate this amount by simply multiplying an owner’s hours spent performing this work by a reasonable FMV wage.

Owners’ G&A overhead salaries are for their time running the company. I calculate this amount by asking, “What would I pay someone to manage the company?” Then I apply our salary benchmark. The total of owner’s G&A overhead salary plus all other G&A personnel wages (office manager, receptionist, account and project managers, estimators, etc.) should not exceed 12 percent of company sales.

Grow the bottom line.

Figures for your company will no doubt vary from our two scenarios. However, these examples will help you calculate an FMV number for what you should expect to earn from your business.

To this number add dividends, which primarily depend upon the profitability of the business. The more profitable the business, the greater the dividends can be. Remember, the fair market value part of your total remuneration is based upon the size and structure of your business. The second part, dividends, depend upon on how well you run the company. L&L

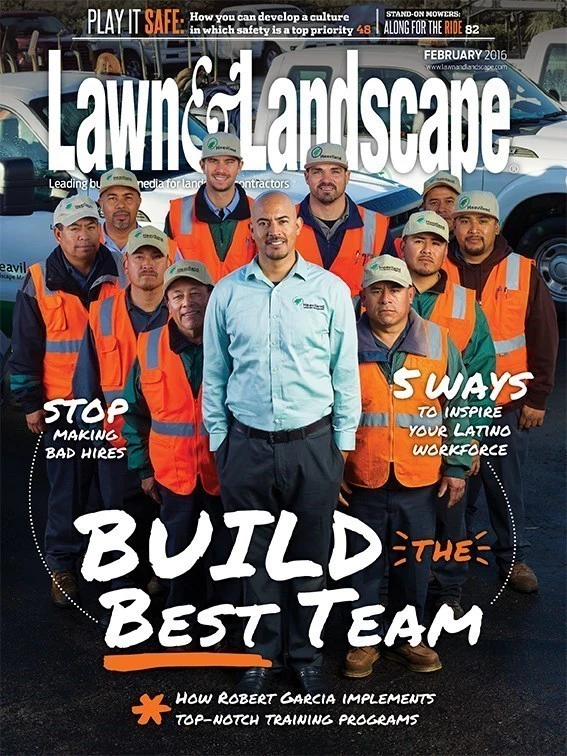

Explore the February 2016 Issue

Check out more from this issue and find your next story to read.

Latest from Lawn & Landscape

- Project EverGreen helps revitalize Milan Park in Detroit

- Trex Company wins Product of the Year, Judges’ Choice Winner at Environment+Energy Leader Awards

- General Equipment & Supplies in Fargo adds Takeuchi equipment

- Mariani Premier Group acquires Hazeltine Nurseries

- EnP Investments adds Mark McCarel as Northeast territory sales manager

- Our April issue is now live

- Ready or not

- Tribute to an industry guru