Having trouble getting paid? When your accounts receivable is dragging, you’ll feel the pain with low cash flow or worse: trouble paying your own expenses like payroll or vendors. Timely collections are critical for operating a healthy business. Here are seven strategies to help you get paid faster.

Provide payment options. Make paying your invoices as convenient as possible. Today, that means offering an online payment option and accepting credit cards. “People need an easy way to pay,” says Missy Fromme, co-owner of Lawn Cure in Sellersburg, Indiana.

Country Club Lawn and Tree Specialists in South Roxana, Illinois, offers a $5 or $10 credit toward clients’ accounts when they set up an online account or select auto pay. “For new customers, we make sure we get their email addresses and we ask if they want to set up credit card billing or auto-pay,” says Mark Black, owner.

At ValleyGreen in Sartell, Minnesota, 60 percent of clients pay by credit card. “We also take credit cards over the phone or customers can pay by credit card online through our website,” says Michael Hornung, president.

Latest from Lawn & Landscape

- LawnPro Partners acquires Ohio's Meehan’s Lawn Service

- Landscape Workshop acquires 2 companies in Florida

- How to use ChatGPT to enhance daily operations

- NCNLA names Oskey as executive vice president

- Wise and willing

- Case provides Metallica's James Hetfield his specially designed CTL

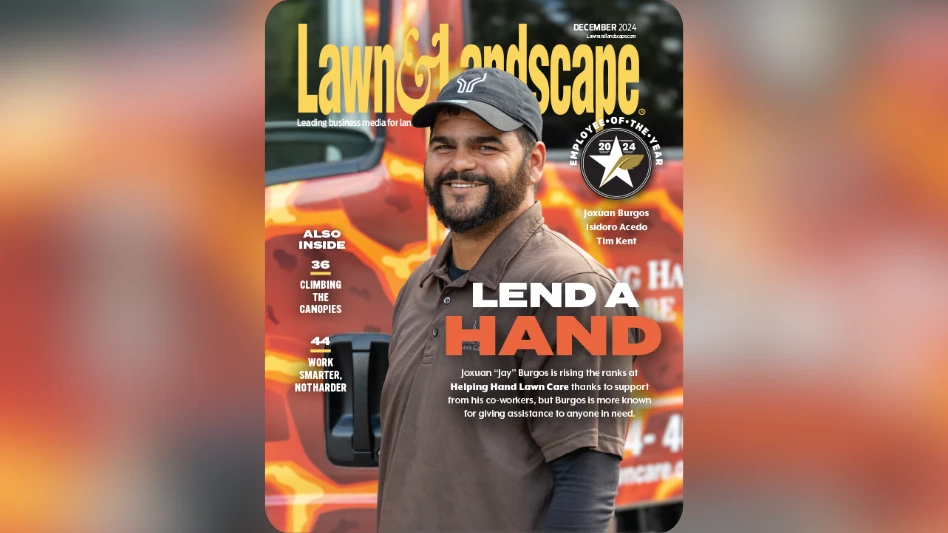

- Lend a hand

- What you missed this week