By Jimmy Miller

To some, there’s no word in the English language more frightening than “recession.”

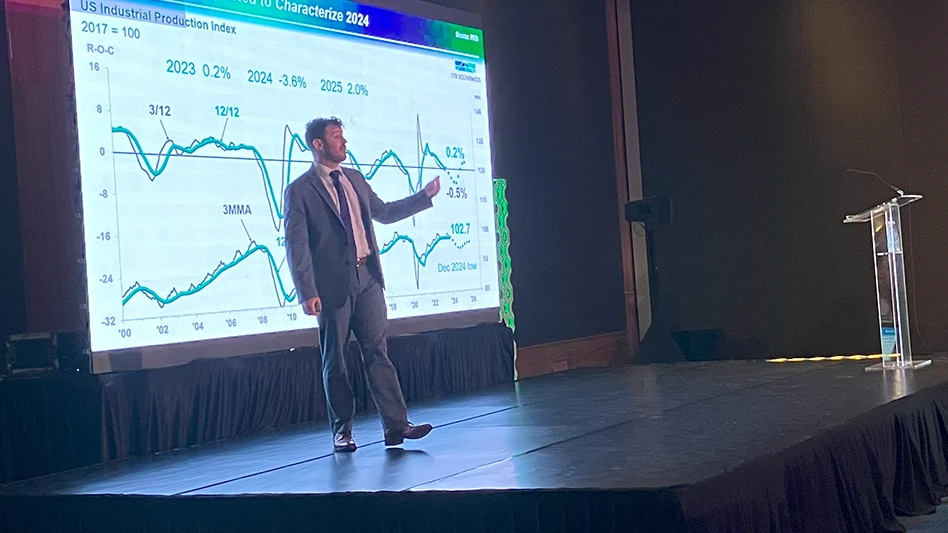

Yes, Taylor St. St. Germain told NALP Leaders Forum attendees that a recession is coming. St. Germain would know: He’s an economist and speaker at ITR Economics, which offers business management consulting based on the latest economic trends in the U.S. The Leaders Forum event was held earlier this month in Mexico.

So, St. Germain admits that using the "recession" buzzword — the one that preceded an awful economy in 2008 — likely gives landscapers some PTSD. But he reassured attendees that the affect will be minimal: He projects a reduction in U.S. GDP of just 0.2% in 2024.

He tried to put that figure in perspective, adding that the U.S. economy goes into some sort of a recession every 10 years dating all the way back to World War II. Here, he’s not so concerned with how businesses may struggle in 2024; he’s more concerned they won’t be able to handle all the new business that may come their way in 2025.

After this slight dip in GDP in 2024, he’s projecting growth each year until 2030.

“My concern is that we’re not prepared for how quickly we’re coming back in 2025,” he says. “(This year’s) a time to invest in efficiencies because we have five consecutive years of GDP growth coming in the U.S.”

St. Germain shared consumer data with the forum attendees, demonstrating the narrative about consumers being in an awful position to spend is wrong. Sure, the current data shows a slight decrease in how much they can spend, but that’s only because they received stimulus checks during the COVID-19 pandemic. Those same consumers are now just returning back to the steadily growing strong position they were in beforehand.

St. Germain also suggested the labor shortage isn’t going anywhere.

“The only takeaway you need: For every open job, we have 0.7 people,” he says.

He believes there’s two ways the U.S. can approach this shortage: changes to the immigration policies or automation. The latter seems far more likely than the other to him, as even the mild recession in 2024 won’t fix the labor shortage.

“Everyone’s afraid of robots, but we’re going to need them,” St. Germain says. “Even through an economic downturn, you’re going to need employees. Be cautious about layoffs in 2024 because that activity is coming back in 2025 and 2026.”

There’s a narrative that people don’t want to work anymore, which St. Germain says he doesn’t believe. “We just had a record-high labor participation rate,” he says, “so I don’t buy that.” He does add that labor participation in people aged 16-24 has dwindled significantly.

He says there’s lots of different theories on that, but regardless, he encourages companies to engage those employees differently than they might with their older generations. St. Germain points to one of his clients that let their youngest employees lead a website redesign, which he directly attributes now to millions of dollars in growth.

Ballooning material costs and employee wages became an industry-wide story since COVID-19. St. Germain says that while wage inflation is certainly still a reality, material costs are starting to go down. With that, means less pricing power than before, where companies could pass price increases down to the consumer under the idea that things cost more money than before.

St. Germain says 59 of his 60 clients are already being asked to keep their current prices steady or, in some cases, drop their prices down some. He advises companies to brace for tougher conversations by citing wage inflation rather than increased material costs if they decide to increase their prices.

“If you’re part of a sales team, prepare for challenging pricing conversations this year,” he says. “Margin benefit is going to come from the cost savings side rather than the price increase side.”

St. Germain’s also detailed an outlook where residential construction is about to rise while commercial construction will taper off. They’re counter-cyclical, and St. Germain says that after the Federal Reserve increased interest rates, the housing market plummeted. He also pointed out that housing market data traditionally beats the commercial market by two full years.

He says the building permit process is still a huge pain, but the improvement in the market itself is still demonstrable. Housing unit permits by state data show that only Nebraska, New Hampshire and Alaska are the only states not recovering. And there’s some positive growth rates in remodeling construction nationwide, though there’s less overall than there was during the pandemic.

“The worst of the housing decline is behind us,” St. Germain says. “We have growth in the next three years.”

Latest from Lawn & Landscape

- Echo secures Sourcewell contract for public agencies

- New AI startup Plantista launches crowdfund for firewise landscaping

- Residential in the rear view

- Harness the Power of Emotion to Attract Lawn Care Clients

- Ignite Attachments introduces tree and fence post puller

- Landscape Workshop acquires 2 in Virginia markets

- Schill Grounds Management acquires Elevations Landscaping

- Central Turf & Irrigation rebrands as Central Pro Supply